Homeownership and Understanding Student Loan Repayment Options

By Michael Zuren, PhD Updated on 7/27/2017 Options exist to help prospective borrowers obtain the mortgage they want, despite having student loan debt.

Options exist to help prospective borrowers obtain the mortgage they want, despite having student loan debt.

Who has student debt?

Nearly 60% of all college students in the calendar year 2011 –2012 accrued debt via student loans. It's estimated that in 2012, student loan debt exceeded one trillion dollars.

According to The Federal Reserve Bank of New York, student loan debt is the only form of consumer debt that has increased since 2008. The data below shows student loan debt reaches its high point in the age group of 30 to 39.

Age Group | Under 30 | 30 to 39 |

Student Loan Debt | 350 million | 350 million |

Number of Borrowers | 15 million | 10 million |

Average Student Loan Balance | $20K | $30K |

There are options for potential home buyers with large student loan debt. These include: (1) FHA financing, and (2) student loan repayment options. The information below details these alternatives for home buyers.

FHA Mortgage Option

Federal Housing Administration (FHA) does not count student loan payments if the payments are deferred for at least 12 months after the mortgage closes.

According to the Housing and Urban Development Agency (HUD) student loans must be included as monthly debt obligation in the debt ratio if the payments start within 12 months of the mortgage closing unless documentation is provided proving the debt is deferred beyond the 12-month time frame.

Student Loan Repayment Options

If the college graduate has exhausted their forbearance and deferment options for their student loans, there are alternative repayment plans that may assist limiting their monthly payments. Exploring these options may enable the college graduated to qualify for mortgage financing.

The income based repayment plans offer the lowest monthly payment options. The U.S. Department of Education offers multiple repayment plans for student loans based on the borrower’s income. Even if a repayment plan has already been selected, the repayment plan can be changed at any time.

Below is a summary of Direct Loan and Family Federal Education Loan (FFEL) Program Repayment Plans.

Repayment Plan | Eligible Loans | Monthly Payment and Time Frame | Simple Comparison |

Standard Repayment Plan | Direct Subsidized and Unsubsidized Loans, subsidized and Unsubsidized Federal Stafford Loans, and PLUS Loans. | Payments are a fixed amount of at least $50 per month. | Less Interest is paid under this plan than other plans. |

Graduated Repayment Plan | Direct Subsidized and Unsubsidized Loans, subsidized and Unsubsidized Federal Stafford Loans, and PLUS Loans. | Payments are lower at first and then increase, usually every two years. Up to 10 years. | This plan will has more interest expense than the standard plan. |

Extended Repayment Plan | Direct Subsidized and Unsubsidized Loans, subsidized and Unsubsidized Federal Stafford Loans, and PLUS Loans. | Payment may be fixed or graduated.

| Monthly payments are lower than the 10 year standard plan.

|

Income Based Repayment Plan | Direct Subsidized and Unsubsidized Loans, Subsidized and Unsubsidized Federal Stafford Loans, and PLUS Loans.

| The maximum monthly payments are 15% of discretionary income, which is the difference between the adjusted gross income and 150% of the poverty guideline based on family size and location. Payment may change as income changes. Up to Twenty-Five Years. | Must have a partial financial hardship. Monthly payments are lower but interest expense is higher than the 10-year standard plan. Any unpaid amount after 25 years of making qualified monthly payments may be forgiven but any forgiven amount may be taxable. |

Pay as You Earn Repayment Plan | Direct Subsidized and Unsubsidized Loans, and Direct PLUS loans made to students. Consolidation Loans (Direct or FFEL) that do not include Direct or FFEL Plus Loans made to parents. | The maximum monthly payments are 10% of discretionary income, which is the difference between the adjusted gross income and 150% of the poverty guideline based on family size and location. Payment may change as income changes. Up to 25 years. | Must have a partial financial hardship. Must be a new borrower on or after October 1, 2007, and must have received a disbursement of a direct loan on or after October 1, 2011. Payments will be lower but interest expense will be greater than the standard 10-year plan. Any unpaid amount after 20 years of making qualified monthly payments may be forgiven, but any forgiven amount may be taxable. |

Income Contingent Repayment Plan | Direct Subsidized and Unsubsidized Loans, Direct Plus Loans made to student, and Direct Consolidation Loans. | Payments are calculated based on adjusted gross income, family size, and total amount of Direct Loans. Payments change with income. Up to twenty-five years. | Payments will be lower but interest expense will be greater than the standard 10 year plan. Any unpaid amount after 25 years of making qualified monthly payments may be forgiven but any forgiven amount may be taxable. |

Income Sensitive Repayment Plan | Subsidized and Unsubsidized Federal Stafford Loans, FFEL Plus Loans, and FFEL Consolidation Loans. | Monthly payment is based on annual income. Payments change with income. Up to ten years. | Payments will be lower but interest expense will be greater than the standard 10 year plan. Monthly payment can vary per loan servicers’ repayment formula. |

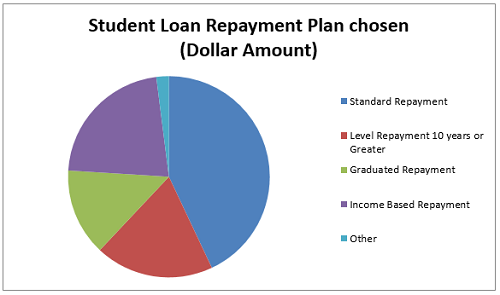

The below pie chart shows the student loan repayment plans chosen by the recipients in 2013. Make a note of the most popular options, but consult an advisor to choose the best program for you.

Sources:

National Associations of Realtors

Didn't find the answer you wanted? Ask one of your own.

-

Letter of Explanation for Credit Issues

View More

Letter of Explanation for Credit Issues

View More

Contributing Authors

Related Articles

Ask our community a question.

Searching Today's Rates...

Featured Lenders

Lisa Stepp

RBS Citizens

Clifton Park, NY

Kat Whitman

Whitman Met, Inc.

Sacramento, CA

Cameron Burke

Vision One Mortgage

Huntington Beach, CA