Va Home Loan Articles

What are the requirements for a VA loan?

This article does not address the VA Loan Eligibility but describes in detail the standards that Veterans of the United States must meet for getting a loan from the Department of Veteran Affairs. Under certain circumstances, like job relocation, a veteran may borrow two VA...

This article does not address the VA Loan Eligibility but describes in detail the standards that Veterans of the United States must meet for getting a loan from the Department of Veteran Affairs. Under certain circumstances, like job relocation, a veteran may borrow two VA...

Who is Eligible for a VA Loan ?

The Department of Veteran Affairs has specific guidelines for VA Loan eligibility that depend on the length of term served, conditions of the discharge, conditions of service (peacetime or wartime), and the branch of military served. . If you have ever served in the...

The Department of Veteran Affairs has specific guidelines for VA Loan eligibility that depend on the length of term served, conditions of the discharge, conditions of service (peacetime or wartime), and the branch of military served. . If you have ever served in the...

VA Loan Frequently Asked Questions

Why get a VA loan?VA loans provide exceptional benefits. For instance, VA loans allow borrowers to purchase a home without a down payment, one of the few remaining mortgage loans with this characteristic. . The VA also limits the amount of closing costs which...

Why get a VA loan?VA loans provide exceptional benefits. For instance, VA loans allow borrowers to purchase a home without a down payment, one of the few remaining mortgage loans with this characteristic. . The VA also limits the amount of closing costs which...

VA Loan Certificate of Eligibility

To receive a VA guaranteed loan, applicants must acquire a Certificate of Eligibility (COE). Applicants eligible to receive a Certificate of Eligibility for a VA loan are divided into three categories:. VeteransActive Duty Service personsReservists or Members of the...

To receive a VA guaranteed loan, applicants must acquire a Certificate of Eligibility (COE). Applicants eligible to receive a Certificate of Eligibility for a VA loan are divided into three categories:. VeteransActive Duty Service personsReservists or Members of the...

VA Loan Benefits

Due to the VA Home Loan program's flexibility, guaranteed backing by the federal government, and major benefits, a VA home loan can help members of the service who may otherwise struggle to find and purchase a home of their own.. Down Payments Not Required for a VA LoanSince...

Due to the VA Home Loan program's flexibility, guaranteed backing by the federal government, and major benefits, a VA home loan can help members of the service who may otherwise struggle to find and purchase a home of their own.. Down Payments Not Required for a VA LoanSince...

VA Loan Closing Costs

For military borrowers, VA loans provide exceptional benefits exclusive to active duty servicepersons and military veterans. To provide assistance for veterans, the Department of Veteran Affairs (VA) enforces strict guidelines on the closing costs which lenders can...

For military borrowers, VA loans provide exceptional benefits exclusive to active duty servicepersons and military veterans. To provide assistance for veterans, the Department of Veteran Affairs (VA) enforces strict guidelines on the closing costs which lenders can...

VA Loan Forgiveness - Debt Forgiveness for U.S. Veterans

The United States military has several programs in place that are designed to help military service members and their families avoid foreclosure and manage their debt. . Most military bases have a Family Support Center for financial counseling. The counselors can help...

The United States military has several programs in place that are designed to help military service members and their families avoid foreclosure and manage their debt. . Most military bases have a Family Support Center for financial counseling. The counselors can help...

VA Loan Short Sale Guidelines

VA Loan Short SaleTo counter the difficulties of owning a mortgage while being subject to relocation, the Department of Veteran Affairs (VA) offers guaranteed VA loans. . When VA borrowers undergo a short sale, the transaction is referred to as an “offer in...

VA Loan Short SaleTo counter the difficulties of owning a mortgage while being subject to relocation, the Department of Veteran Affairs (VA) offers guaranteed VA loans. . When VA borrowers undergo a short sale, the transaction is referred to as an “offer in...

VA Loan Modification

For veterans who have purchased a home with a VA loan, the VA offers loan modification as an option. It allows borrowers to alter the terms of the loan to make the payments more affordable and to facilitate consistent monthly payments better.. While not always the...

For veterans who have purchased a home with a VA loan, the VA offers loan modification as an option. It allows borrowers to alter the terms of the loan to make the payments more affordable and to facilitate consistent monthly payments better.. While not always the...

Understanding the VA Loan Application Process

Here are a few easy and cohesive steps to a smart and stress-free VA loan application process. 1. Get a Certificate of Eligibility (COE).The first step of the VA loan application process requires that you must qualify for a VA loan. A Certificate of Eligibility, or COE, assures the...

Here are a few easy and cohesive steps to a smart and stress-free VA loan application process. 1. Get a Certificate of Eligibility (COE).The first step of the VA loan application process requires that you must qualify for a VA loan. A Certificate of Eligibility, or COE, assures the...

Benefits of Refinancing With a VA Mortgage

VA loans offer tremendous benefits to qualified military personnel. Many are unaware that the VA loan program also helps homeowners refinance their existing mortgages.. Refinancing a VA loan is a great option for many qualified homeowners, especially in the current...

VA loans offer tremendous benefits to qualified military personnel. Many are unaware that the VA loan program also helps homeowners refinance their existing mortgages.. Refinancing a VA loan is a great option for many qualified homeowners, especially in the current...

Approval of VA Lenders

VA loan mortgages offer exceptional benefits exclusive to military servicepersons and veteran borrowers. However, these loans cannot be acquired from all lenders; rather, VA-eligible borrowers must find VA lenders who have been approved by the Department of Veteran...

VA loan mortgages offer exceptional benefits exclusive to military servicepersons and veteran borrowers. However, these loans cannot be acquired from all lenders; rather, VA-eligible borrowers must find VA lenders who have been approved by the Department of Veteran...

Can I get a VA Loan after Short Sale or Foreclosure?

VA mortgages are among the best home financing options available today. Veterans have earned the right to secure this unique mortgage opportunity that offers 100 percent financing and no mortgage insurance.. Work with an experienced VA loan officer that is familiar...

VA mortgages are among the best home financing options available today. Veterans have earned the right to secure this unique mortgage opportunity that offers 100 percent financing and no mortgage insurance.. Work with an experienced VA loan officer that is familiar...

VA Loan Down Payment

Unlike FHA home loans and Conventional Loan programs, VA mortgage loans offer qualified borrowers the option of a zero down payment. However, other fees and restrictions apply.. VA Down Payment Guidelines:All borrowers may not have the option of omitting a VA down payment....

Unlike FHA home loans and Conventional Loan programs, VA mortgage loans offer qualified borrowers the option of a zero down payment. However, other fees and restrictions apply.. VA Down Payment Guidelines:All borrowers may not have the option of omitting a VA down payment....

Securing a VA Business Loan

Patriot Express Loans and Military Reservist Economic Injury Disaster Loans are guaranteed loans offered by the Small Business Administration (SBA) for Veterans, active duty servicepersons, and their spouses. . While not a common type of VA loan, VA business loans...

Patriot Express Loans and Military Reservist Economic Injury Disaster Loans are guaranteed loans offered by the Small Business Administration (SBA) for Veterans, active duty servicepersons, and their spouses. . While not a common type of VA loan, VA business loans...

VA Loan Appraisals and Home Inspection

Unlike regular appraisals, VA appraisals take additional factors into consideration and can present challenges to some borrowers, especially those considering purchasing fixer-upper properties. . Facilitate a smooth appraisal process for VA...

Unlike regular appraisals, VA appraisals take additional factors into consideration and can present challenges to some borrowers, especially those considering purchasing fixer-upper properties. . Facilitate a smooth appraisal process for VA...

5 Common Obstacles to VA Home Inspection

Military borrowers face the most difficulty during the VA home appraisal and the mandatory VA home inspection. . Before closing the loan, the Department of Veteran Affairs enforces several criteria for Minimum Property Requirements (MPR) before extending the...

Military borrowers face the most difficulty during the VA home appraisal and the mandatory VA home inspection. . Before closing the loan, the Department of Veteran Affairs enforces several criteria for Minimum Property Requirements (MPR) before extending the...

What is VA Funding Fee?

To secure home loan benefits through the Department of Veteran Affairs (VA), VA-eligible borrowers must pay a mandatory VA funding fee. Through this charge, the borrower contributes toward the cost of the highly advantageous VA mortgage loan program, thereby lessening...

To secure home loan benefits through the Department of Veteran Affairs (VA), VA-eligible borrowers must pay a mandatory VA funding fee. Through this charge, the borrower contributes toward the cost of the highly advantageous VA mortgage loan program, thereby lessening...

Buying a VA-Approved Condo

A VA condominium ownership can have numerous benefits over home ownership; with a much lower monthly cost and attractive or convenient amenities, buying a condo with a VA loan could be optimal for some borrowers.. However, not all mortgage loans can be used to purchase...

A VA condominium ownership can have numerous benefits over home ownership; with a much lower monthly cost and attractive or convenient amenities, buying a condo with a VA loan could be optimal for some borrowers.. However, not all mortgage loans can be used to purchase...

Fees associated with VA Loans

Many prospective borrowers are curious about what VA loan fees will be charged in connection with their loan, and more specifically, how much cash is necessary upon closing. . When looking at all of the fees, many of them can be negotiated with and paid by the seller...

Many prospective borrowers are curious about what VA loan fees will be charged in connection with their loan, and more specifically, how much cash is necessary upon closing. . When looking at all of the fees, many of them can be negotiated with and paid by the seller...

VA Loan Credit Score Requirements

The credit requirements for the VA home loan program are lenient. However, applicants must still meet the credit and income criteria established by the Department of Veteran Affairs (VA). . While the VA has not set a minimum credit score requirement, most lenders...

The credit requirements for the VA home loan program are lenient. However, applicants must still meet the credit and income criteria established by the Department of Veteran Affairs (VA). . While the VA has not set a minimum credit score requirement, most lenders...

Popular VA Refinance Options

If you are looking to refinance your VA mortgage loan, the two popular options to choose from are: VA cash-out refinance or a VA streamline refinance. . The VA cash-out refinance allows borrowers to extract cash from their home equity, whereas a VA streamline refinance...

If you are looking to refinance your VA mortgage loan, the two popular options to choose from are: VA cash-out refinance or a VA streamline refinance. . The VA cash-out refinance allows borrowers to extract cash from their home equity, whereas a VA streamline refinance...

Finding the Best VA Lender

When a borrower is thinking about taking out a VA home loan, one of the most important pieces of the puzzle is selecting the right lender with whom he or she will be taking out the loan. . A home purchase is easily one of the biggest purchases a borrower can make. As a...

When a borrower is thinking about taking out a VA home loan, one of the most important pieces of the puzzle is selecting the right lender with whom he or she will be taking out the loan. . A home purchase is easily one of the biggest purchases a borrower can make. As a...

VA Hybrid ARM (Adjustable Mortgage)

The VA Hybrid ARM loan combines the qualities of both fixed and adjustable rate mortgages. . This mortgage begins as a fixed rate mortgage for the first 3, 5, 7, or 10 years with interest rates locked into place. Following this period, the mortgage becomes an adjustable...

The VA Hybrid ARM loan combines the qualities of both fixed and adjustable rate mortgages. . This mortgage begins as a fixed rate mortgage for the first 3, 5, 7, or 10 years with interest rates locked into place. Following this period, the mortgage becomes an adjustable...

Understanding the VA Construction Loan Process

The U.S. Department of Veteran Affairs (VA) allows eligible military borrowers to acquire a VA mortgage loan to fund the purchase of both existing and new home constructions. Consider the following factors for VA Construction Loans and the process of constructing a...

The U.S. Department of Veteran Affairs (VA) allows eligible military borrowers to acquire a VA mortgage loan to fund the purchase of both existing and new home constructions. Consider the following factors for VA Construction Loans and the process of constructing a...

Comparison: VA Loans Versus Conventional Mortgages

While you may qualify for both loans, generally there is one option will benefit you more than the other. The main differences between VA loans and conventional loans are the eligibility qualifications, mortgage insurance, and down payment. . For example, if you want to...

While you may qualify for both loans, generally there is one option will benefit you more than the other. The main differences between VA loans and conventional loans are the eligibility qualifications, mortgage insurance, and down payment. . For example, if you want to...

VA Loan Foreclosure and Short Sale

A VA foreclosure happens when a borrower is delinquent on their mortgage payments and their VA loan lender claims ownership of the home that they have financed. . When a VA loan lender forecloses on the borrower, the borrower must move out of the house and loses all...

A VA foreclosure happens when a borrower is delinquent on their mortgage payments and their VA loan lender claims ownership of the home that they have financed. . When a VA loan lender forecloses on the borrower, the borrower must move out of the house and loses all...

Securing a VA Business Loan

Patriot Express Loans and Military Reservist Economic Injury Disaster Loans are guaranteed loans offered by the Small Business Administration (SBA) for Veterans, active duty servicepersons, and their spouses. . While not a common type of VA loan, VA business loans...

Patriot Express Loans and Military Reservist Economic Injury Disaster Loans are guaranteed loans offered by the Small Business Administration (SBA) for Veterans, active duty servicepersons, and their spouses. . While not a common type of VA loan, VA business loans...

VA Loan for Land Purchase

VA guidelines allow eligible borrowers to finance the purchase of mobile homes, manufactured homes, or even land. While many websites may say otherwise, VA mortgage loans can be applied toward land purchases under the right circumstances.. Purchasing Land with a VA LoanThe...

VA guidelines allow eligible borrowers to finance the purchase of mobile homes, manufactured homes, or even land. While many websites may say otherwise, VA mortgage loans can be applied toward land purchases under the right circumstances.. Purchasing Land with a VA LoanThe...

Can I get a VA Loan with Bad Credit?

A VA loan is a loan guaranteed by the Department of Veteran Affairs. Somewhat of a misnomer, VA loans are not issued by Veteran Affairs but by VA-approved lenders. These loans provide financial assistance to veterans and active duty service persons in various ways. . One of...

A VA loan is a loan guaranteed by the Department of Veteran Affairs. Somewhat of a misnomer, VA loans are not issued by Veteran Affairs but by VA-approved lenders. These loans provide financial assistance to veterans and active duty service persons in various ways. . One of...

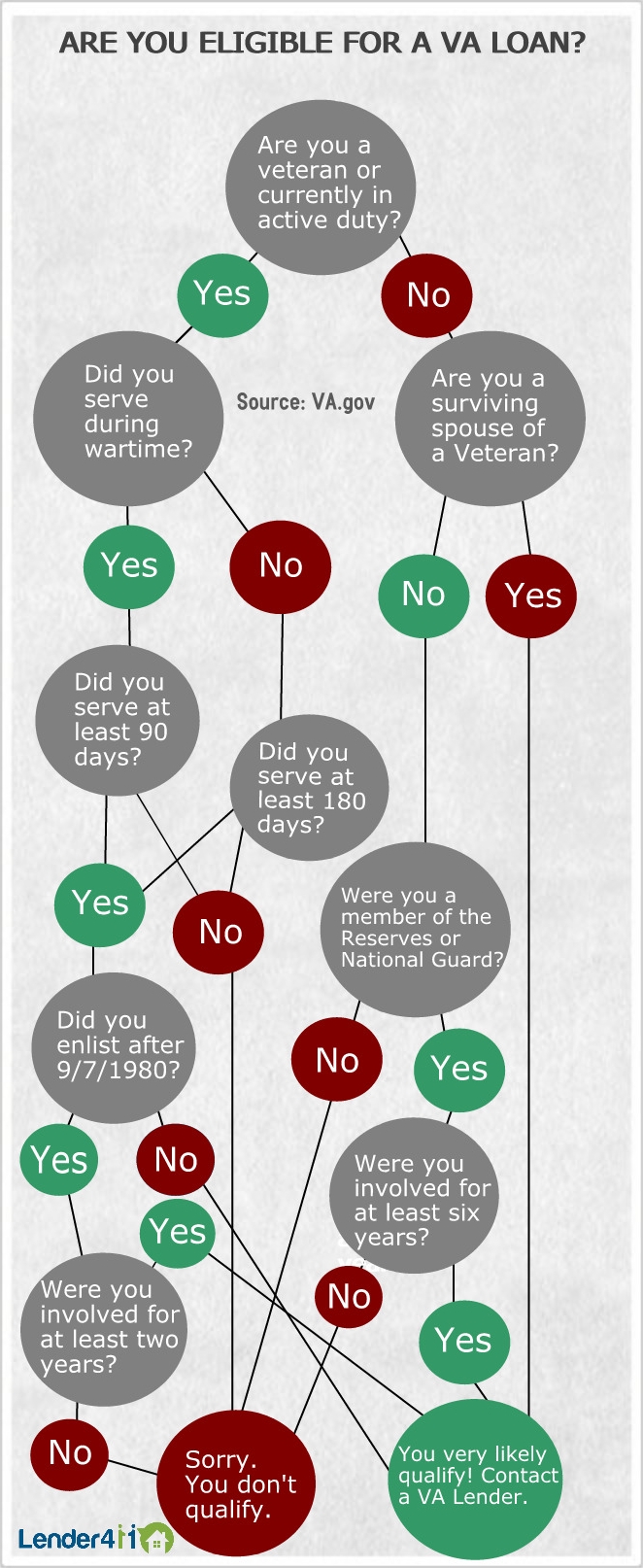

Infographic: VA Loan Eligibility

This infographic explains the VA loan eligibility for prospective borrowers. This is a flow chart to express the circumstances for veterans, active duty military and their spouses to qualify for a va home loan..

This infographic explains the VA loan eligibility for prospective borrowers. This is a flow chart to express the circumstances for veterans, active duty military and their spouses to qualify for a va home loan..