Home Refinance Articles

Refinancing - Things to Consider

There are three primary aspects to refinancing: the interest rate, loan length, and fees. These aspects should be weighed against the existing loan and the amount of time the borrower is planning to stay in their home. . When not done properly, refinancing...

There are three primary aspects to refinancing: the interest rate, loan length, and fees. These aspects should be weighed against the existing loan and the amount of time the borrower is planning to stay in their home. . When not done properly, refinancing...

Mortgage Refinance Overview

Our detailed overview will provide you with all the refinance information you need to take control of your financial situation and make an informed decision about your mortgage.. Refinancing a Home MortgageIn a refinance, you take out a new home loan and use it to pay off your...

Our detailed overview will provide you with all the refinance information you need to take control of your financial situation and make an informed decision about your mortgage.. Refinancing a Home MortgageIn a refinance, you take out a new home loan and use it to pay off your...

Mortgage Refinance Tips

Refinancing your mortgage is an excellent way to reduce your monthly mortgage payment and create additional cash flow for savings or other pursuits. Weigh your options to see if a refinance makes sense for your financial situation. . Start your decision-making process...

Refinancing your mortgage is an excellent way to reduce your monthly mortgage payment and create additional cash flow for savings or other pursuits. Weigh your options to see if a refinance makes sense for your financial situation. . Start your decision-making process...

Refinance Closing Costs

The costs of a refinance will differ depending on your lender, location, and loan amount. However, some costs will most likely stay the same. In general, you will end up paying anywhere from 3% to 6% of the loan’s principal balance.. Upfront FeesWhen you refinance a home,...

The costs of a refinance will differ depending on your lender, location, and loan amount. However, some costs will most likely stay the same. In general, you will end up paying anywhere from 3% to 6% of the loan’s principal balance.. Upfront FeesWhen you refinance a home,...

Conventional Versus FHA Refinancing

Refinance loan options can be split into two categories: conventional mortgage loans and government-insured, most commonly those insured by the Federal Housing Administration (FHA). . While both conventional and FHA loans each have their advantages, borrowers...

Refinance loan options can be split into two categories: conventional mortgage loans and government-insured, most commonly those insured by the Federal Housing Administration (FHA). . While both conventional and FHA loans each have their advantages, borrowers...

5 Common Obstacles to Refinancing

Refinancing an existing mortgage can be much simpler than obtaining a brand new home purchase mortgage from scratch. . Despite this, refinancing can be difficult for some borrowers. If you're hoping to refinance your mortgage, consider the following obstacles:. 1....

Refinancing an existing mortgage can be much simpler than obtaining a brand new home purchase mortgage from scratch. . Despite this, refinancing can be difficult for some borrowers. If you're hoping to refinance your mortgage, consider the following obstacles:. 1....

HARP 2.0 Eligibility and Qualifications

What is the HARP 2.0?HARP 2.0 is a readjustment of the original HARP (Home Affordable Refinance Program). It's a mortgage tool for those who can't refinance their mortgages the conventional way due to their loan-to-value (LTV) ratio exceeding the value of their home...

What is the HARP 2.0?HARP 2.0 is a readjustment of the original HARP (Home Affordable Refinance Program). It's a mortgage tool for those who can't refinance their mortgages the conventional way due to their loan-to-value (LTV) ratio exceeding the value of their home...

Refinancing a Conventional Loan

There are several reasons why one would want to refinance from a government-backed loan into a conventional loan. . Conventional Loan RequirementsCredit: Generally, borrowers should have a credit score of at least 620 with a solid credit history to refinance, though higher...

There are several reasons why one would want to refinance from a government-backed loan into a conventional loan. . Conventional Loan RequirementsCredit: Generally, borrowers should have a credit score of at least 620 with a solid credit history to refinance, though higher...

HARP 2.0 FAQ

The Home Affordability Refinance Program (HARP) is a refinance program created to assist homeowners with financial hardships and seek an affordable payment plan. . The concept of HARP is to prevent the housing market from crashing like in 2008, which led to a severe...

The Home Affordability Refinance Program (HARP) is a refinance program created to assist homeowners with financial hardships and seek an affordable payment plan. . The concept of HARP is to prevent the housing market from crashing like in 2008, which led to a severe...

Should I Get a Second Mortgage or Refinance?

You have options when doing a cash-out refinance to get cash from your current home mortgage or extracting some of the equity through a home equity loan (HEL) or home equity line of credit (HELOC). . While both options have advantages and disadvantages, you will...

You have options when doing a cash-out refinance to get cash from your current home mortgage or extracting some of the equity through a home equity loan (HEL) or home equity line of credit (HELOC). . While both options have advantages and disadvantages, you will...

How to Refinance After Bankruptcy

Bankruptcy can be very unsettling, demoralizing and stressful. The challenge of obtaining a mortgage after a bankruptcy has increased with new regulations. But it is still possible to obtain a mortgage if you plan accordingly and take steps toward financial recovery....

Bankruptcy can be very unsettling, demoralizing and stressful. The challenge of obtaining a mortgage after a bankruptcy has increased with new regulations. But it is still possible to obtain a mortgage if you plan accordingly and take steps toward financial recovery....

How to Transfer a Mortgage

A mortgage transfer is defined as a transaction in which the borrower, or lender, assigns an existing mortgage to another person or entity. If a mortgage can be transferred, it is referred to as “assumable".. Assumable mortgages fade in and out of popularity...

A mortgage transfer is defined as a transaction in which the borrower, or lender, assigns an existing mortgage to another person or entity. If a mortgage can be transferred, it is referred to as “assumable".. Assumable mortgages fade in and out of popularity...

Benefits of FHA Streamline Refinance

Homeowners with mortgages insured by the Federal Housing Administration (FHA) have a unique refinance option, known as the FHA streamline refinance. Unlike the standard FHA refinance, the streamline variant requires significantly reduced up-front costs and...

Homeowners with mortgages insured by the Federal Housing Administration (FHA) have a unique refinance option, known as the FHA streamline refinance. Unlike the standard FHA refinance, the streamline variant requires significantly reduced up-front costs and...

Requirements for FHA Streamline Refinance

You must have an FHA loan to be eligible for an FHA Streamline Refinance.. Other requirements include the following.. You must be current on your mortgage paymentsYou can't have had any late payments in the past three monthsYou can't have had any more than one late...

You must have an FHA loan to be eligible for an FHA Streamline Refinance.. Other requirements include the following.. You must be current on your mortgage paymentsYou can't have had any late payments in the past three monthsYou can't have had any more than one late...

Calculating your Refinance Closing Costs

When refinancing, borrowers should calculate the costs of the refinance against the potential benefits. Typically, this requires comparing the gains of a lower interest rate or shorter term against the cost of securing a refinance loan. . However, evaluating the cost...

When refinancing, borrowers should calculate the costs of the refinance against the potential benefits. Typically, this requires comparing the gains of a lower interest rate or shorter term against the cost of securing a refinance loan. . However, evaluating the cost...

Refinancing An ARM Loan

Stuck in a loan with a rising interest rate? After an initial period of low payments, adjustable-rate mortgage or ARM loan terms can be very financially damaging for borrowers. . Refinancing with an ARM can get you out of this volatile situation and help you...

Stuck in a loan with a rising interest rate? After an initial period of low payments, adjustable-rate mortgage or ARM loan terms can be very financially damaging for borrowers. . Refinancing with an ARM can get you out of this volatile situation and help you...

Can a Low Appraisal Affect My Refinance Options?

You can't rely solely on sound financial standing when you're refinancing. For an easy refinance approval as well as lowest interest rates, you'll need an accurate home appraisal. . In the past, loan officers had relationships with local...

You can't rely solely on sound financial standing when you're refinancing. For an easy refinance approval as well as lowest interest rates, you'll need an accurate home appraisal. . In the past, loan officers had relationships with local...

Can I Refinance an Investment Property with HARP?

To dispel any confusion, this article will examine the main myths of the Freddie Mac HARP refinance that prevent borrowers from being able to obtain a HARP refinance on investment properties. But first, it's imperative to understand that HARP refinancing...

To dispel any confusion, this article will examine the main myths of the Freddie Mac HARP refinance that prevent borrowers from being able to obtain a HARP refinance on investment properties. But first, it's imperative to understand that HARP refinancing...

VA Loan Modification

For veterans who have purchased a home with a VA loan, the VA offers loan modification as an option. It allows borrowers to alter the terms of the loan to make the payments more affordable and to facilitate consistent monthly payments better.. While not always the...

For veterans who have purchased a home with a VA loan, the VA offers loan modification as an option. It allows borrowers to alter the terms of the loan to make the payments more affordable and to facilitate consistent monthly payments better.. While not always the...

Benefits of Refinancing With a VA Mortgage

VA loans offer tremendous benefits to qualified military personnel. Many are unaware that the VA loan program also helps homeowners refinance their existing mortgages.. Refinancing a VA loan is a great option for many qualified homeowners, especially in the current...

VA loans offer tremendous benefits to qualified military personnel. Many are unaware that the VA loan program also helps homeowners refinance their existing mortgages.. Refinancing a VA loan is a great option for many qualified homeowners, especially in the current...

Popular VA Refinance Options

If you are looking to refinance your VA mortgage loan, the two popular options to choose from are: VA cash-out refinance or a VA streamline refinance. . The VA cash-out refinance allows borrowers to extract cash from their home equity, whereas a VA streamline refinance...

If you are looking to refinance your VA mortgage loan, the two popular options to choose from are: VA cash-out refinance or a VA streamline refinance. . The VA cash-out refinance allows borrowers to extract cash from their home equity, whereas a VA streamline refinance...

Analyzing HARP Market Interest Rates

The Home Affordable Refinance Program (HARP) provides homeowners with the opportunity to refinance through HARP 2.0 into the currently low-interest rates.. Responsible homeowners can reduce their monthly mortgage payments with lower HARP interest rates as well as adjust...

The Home Affordable Refinance Program (HARP) provides homeowners with the opportunity to refinance through HARP 2.0 into the currently low-interest rates.. Responsible homeowners can reduce their monthly mortgage payments with lower HARP interest rates as well as adjust...

What is the HARP 3 Refinance?

HARP 3.0 has garnered much attention and could achieve the level of success that many anticipated before the lukewarm reception of the original HARP. Only months after the launch of HARP 2.0, a plan to implement another revision of HARP has been introduced, aptly titled HARP 3.0...

HARP 3.0 has garnered much attention and could achieve the level of success that many anticipated before the lukewarm reception of the original HARP. Only months after the launch of HARP 2.0, a plan to implement another revision of HARP has been introduced, aptly titled HARP 3.0...

Infographic: Should I Refinance My Mortgage

How low can your monthly payment get? See for yourself with our free, personalized refinance quotes. Have a question? Ask our mortgage professionals an annoymous question!.

How low can your monthly payment get? See for yourself with our free, personalized refinance quotes. Have a question? Ask our mortgage professionals an annoymous question!.

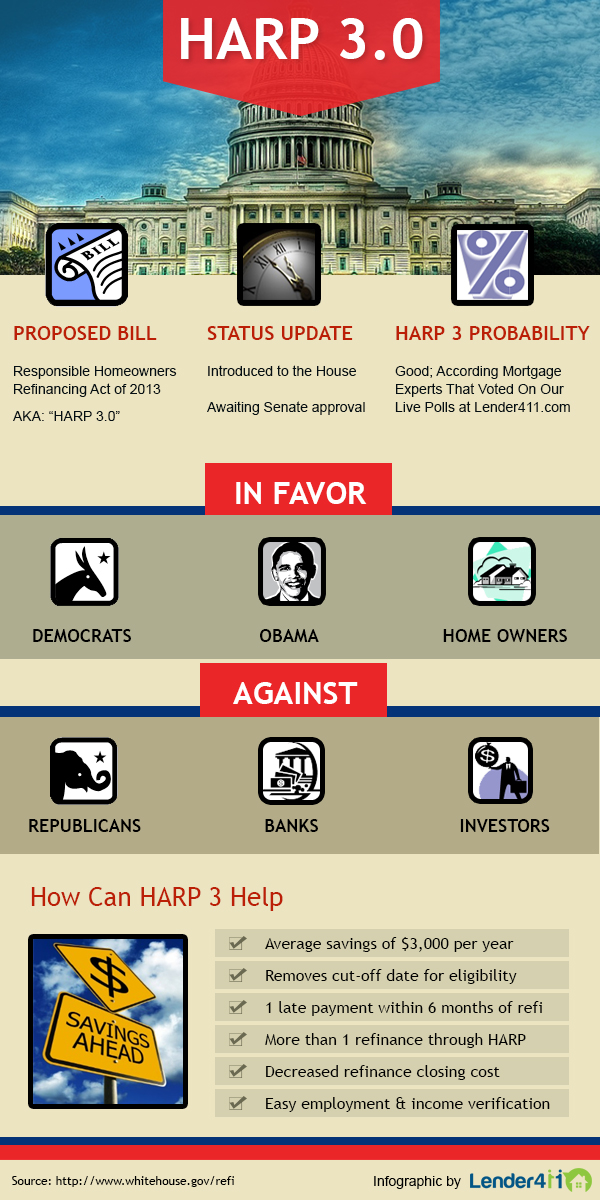

Infographic: HARP 3.0

Want to lower your house payment? HARP refinance is your best option. This government assisted refinance option allows you to modify your current loan to lower interest rates. HARP 3.0 is a revision to the current program, which includes a decrease in restrictions for...

Want to lower your house payment? HARP refinance is your best option. This government assisted refinance option allows you to modify your current loan to lower interest rates. HARP 3.0 is a revision to the current program, which includes a decrease in restrictions for...

Mortgage Rates 6-19-2013

Today's mortgage rates continued to slip upwards, approaching the 52-week high reached last week, demonstrating continuing instability. Recent rate trends indicate rates have risen in response to rising consumer confidence and optimistic economic data.. 30-year...

Today's mortgage rates continued to slip upwards, approaching the 52-week high reached last week, demonstrating continuing instability. Recent rate trends indicate rates have risen in response to rising consumer confidence and optimistic economic data.. 30-year...

Ask our community a question.

Get an answer

Related Articles

Featured Lenders

Kat Whitman

Whitman Met, Inc.

Sacramento, CA

Cameron Burke

Vision One Mortgage

Huntington Beach, CA

Lisa Stepp

RBS Citizens

Clifton Park, NY