Home Purchase Articles

Buying a Home - Things to Consider

Securing the right home mortgage loan involves the consideration of many factors, several of which are mentioned below:. Down Payments + PrincipalDown payments represent the amount of cash investment that you have available to put towards the purchase price of a home, not...

Securing the right home mortgage loan involves the consideration of many factors, several of which are mentioned below:. Down Payments + PrincipalDown payments represent the amount of cash investment that you have available to put towards the purchase price of a home, not...

Mortgage Application Checklist

Below is a list of standard documents that lenders require during the loan application process.. Property:A copy of fully signed sales contract including all riders.. Verification of the deposit you placed to the home (copy of front and back of earnest money check).....

Below is a list of standard documents that lenders require during the loan application process.. Property:A copy of fully signed sales contract including all riders.. Verification of the deposit you placed to the home (copy of front and back of earnest money check).....

How to Choose a Realtor

We've put together a list of the most important interview questions for you to ask your real estate agent to help you find the perfect match that will lead you to your perfect house.. 1. How long have you been in business?There's a running joke that there's...

We've put together a list of the most important interview questions for you to ask your real estate agent to help you find the perfect match that will lead you to your perfect house.. 1. How long have you been in business?There's a running joke that there's...

Using Cash Purchase with Delayed Financing to Win Purchase Money Contracts

The regional North and South Carolina real estate market is turning into a very competitive market. Bidding wars are becoming more and more common. Good for sellers, however, stressful for buyers. And since cash is king, the competition has led to cash...

The regional North and South Carolina real estate market is turning into a very competitive market. Bidding wars are becoming more and more common. Good for sellers, however, stressful for buyers. And since cash is king, the competition has led to cash...

Is buying smaller home the solution to ever rising real estate prices?

The Carolina housing market continues to be a predominately seller's market. The shortage of housing is especially tight in the entry level home buyer price range. The shortage in turn exerts upward pressure on home prices as...

The Carolina housing market continues to be a predominately seller's market. The shortage of housing is especially tight in the entry level home buyer price range. The shortage in turn exerts upward pressure on home prices as...

Home Sales Tax Break: Making the Most of Home Sale Profits

According to economic statistics, home prices have begun to rise slightly this year. While not a drastic rise in prices, this increase provides some relief for the troubled housing market that has been devastated by the bubble burst in 2009.. What does this mean for...

According to economic statistics, home prices have begun to rise slightly this year. While not a drastic rise in prices, this increase provides some relief for the troubled housing market that has been devastated by the bubble burst in 2009.. What does this mean for...

7 Tips for Selling Your Home in a Down Market

We have spoken with many real estate agents and learned their secrets to selling your house in a short amount of time without usually having to change the offering price.. 1. Get a professional appraisal. Getting a professional appraiser to evaluate your home allows you to...

We have spoken with many real estate agents and learned their secrets to selling your house in a short amount of time without usually having to change the offering price.. 1. Get a professional appraisal. Getting a professional appraiser to evaluate your home allows you to...

5 Ways to Qualify for a Mortgage as a Young Adult

In our economic climate, home loans can be difficult to obtain for young adults. For recent college grads and other young adults looking to own a home, the mortgage approval and financing process can be complicated and confusing. . However, with some knowledge and some...

In our economic climate, home loans can be difficult to obtain for young adults. For recent college grads and other young adults looking to own a home, the mortgage approval and financing process can be complicated and confusing. . However, with some knowledge and some...

What is a Conventional Loan?

The term conventional loan describes any mortgage loan that is not guaranteed or insured by the Federal Government. These loans follow the loan limits and guidelines set forth by the Government Sponsored Enterprises (GSEs) Fannie Mae and Freddie Mac. . Some...

The term conventional loan describes any mortgage loan that is not guaranteed or insured by the Federal Government. These loans follow the loan limits and guidelines set forth by the Government Sponsored Enterprises (GSEs) Fannie Mae and Freddie Mac. . Some...

USDA Loan Requirements

The USDA loan program, also referred to as the Rural Development loan, or Rural Housing Loan, is a unique loan product offered by the United States Department of Agriculture (USDA). It provides qualified borrowers with zero down payment, 100% financing at minimal up-front...

The USDA loan program, also referred to as the Rural Development loan, or Rural Housing Loan, is a unique loan product offered by the United States Department of Agriculture (USDA). It provides qualified borrowers with zero down payment, 100% financing at minimal up-front...

Buy a House After Short Sale

Following a short sale, borrowers may find it challenging to obtain mortgage loans at the most advantageous rate.. In some cases, borrowers will be required to put down a larger down payment to compensate for the risk which they present to the lender. At the very least, many loan...

Following a short sale, borrowers may find it challenging to obtain mortgage loans at the most advantageous rate.. In some cases, borrowers will be required to put down a larger down payment to compensate for the risk which they present to the lender. At the very least, many loan...

What is an FHA Loan?

FHA loans are insured by the Federal Housing Administration. Since FHA guarantees to pay the balance in the event of a loan default, rather than the lender having to write it off, FHA loans are open to people with little to no credit history, poor credit history or to those...

FHA loans are insured by the Federal Housing Administration. Since FHA guarantees to pay the balance in the event of a loan default, rather than the lender having to write it off, FHA loans are open to people with little to no credit history, poor credit history or to those...

Buying a Condo ? Consider These Tips

Purchasing a condo can be very much different from purchasing a single family home. One of the most important criteria for deciding whether or not to go with this option is know the monthly maintenance (HOA) fee. . Many buyers are priced out of range due to the high fees that...

Purchasing a condo can be very much different from purchasing a single family home. One of the most important criteria for deciding whether or not to go with this option is know the monthly maintenance (HOA) fee. . Many buyers are priced out of range due to the high fees that...

Factors That Influence Mortgage Interest Rates

Mortgage rates are influenced by many factors including the economy, the stock and bond markets, as well your financial state. While you may not have control over the economy or market, you are in complete control over your finances. . Read below to learn more about...

Mortgage rates are influenced by many factors including the economy, the stock and bond markets, as well your financial state. While you may not have control over the economy or market, you are in complete control over your finances. . Read below to learn more about...

What is an Interest-Only Mortgage?

With an interest-only mortgage, the borrower takes out a 30-year mortgage, electing to pay interest only for a set period, such as 3, 5, 7 or 10 years. . After the end of the interest-only period, the monthly payments readjust to include the principal, and the loan is...

With an interest-only mortgage, the borrower takes out a 30-year mortgage, electing to pay interest only for a set period, such as 3, 5, 7 or 10 years. . After the end of the interest-only period, the monthly payments readjust to include the principal, and the loan is...

Which Closing Costs Are Negotiable?

For home buyers getting a mortgage loan, closing costs are a significant expense, especially combined with the price of a down payment. . As such, borrowers must save up before a home purchase to cover these costs. However, with some sound advice and...

For home buyers getting a mortgage loan, closing costs are a significant expense, especially combined with the price of a down payment. . As such, borrowers must save up before a home purchase to cover these costs. However, with some sound advice and...

Buying a Home after Bankruptcy

In the face of bankruptcy, buying a home may seem like an impossible endeavor. Many people believe that low credit scores prevent them from ever qualifying for a mortgage loan in the future. Although buying a home after bankruptcy is not without challenges, qualifying for a...

In the face of bankruptcy, buying a home may seem like an impossible endeavor. Many people believe that low credit scores prevent them from ever qualifying for a mortgage loan in the future. Although buying a home after bankruptcy is not without challenges, qualifying for a...

Definition of an Adjustable Rate Mortgage (ARM)

An Adjustable Rate Mortgage is a type of loan where the initial mortgage rate remains fixed for a time --typically 3, 5, or 7 years. After this period, the rate begins to shift up or down depending on changes in the mortgage marketplace. . ARM rates are bound to an...

An Adjustable Rate Mortgage is a type of loan where the initial mortgage rate remains fixed for a time --typically 3, 5, or 7 years. After this period, the rate begins to shift up or down depending on changes in the mortgage marketplace. . ARM rates are bound to an...

FHA Inspection Checklist

Qualifying for an FHA loan for your new home must first satisfy a strict FHA inspection, including criteria for health, safety, and security. These inspections are a supplement to the FHA-approved appraisal. . Use this FHA Inspection Checklist to familiarize yourself...

Qualifying for an FHA loan for your new home must first satisfy a strict FHA inspection, including criteria for health, safety, and security. These inspections are a supplement to the FHA-approved appraisal. . Use this FHA Inspection Checklist to familiarize yourself...

What Is a Co-Borrower ?

Following the housing market collapse at the end of the last decade, you may have found it increasingly difficult to acquire home mortgage loans, partly due to stricter lender criteria regarding borrower income, assets, and other factors. . As a result, you may choose...

Following the housing market collapse at the end of the last decade, you may have found it increasingly difficult to acquire home mortgage loans, partly due to stricter lender criteria regarding borrower income, assets, and other factors. . As a result, you may choose...

Advantages of a Larger Down Payment

Many borrowers attempt to secure loans with minimal down payment requirements, but paying more money up front can have numerous advantages.. Pay Less Interest. Putting forth a large sum for a down payment will save borrowers thousands of dollars of accrued interest over the...

Many borrowers attempt to secure loans with minimal down payment requirements, but paying more money up front can have numerous advantages.. Pay Less Interest. Putting forth a large sum for a down payment will save borrowers thousands of dollars of accrued interest over the...

Advantages of an FHA Loan

With so many advantages to the FHA program coupled with conventional loans becoming increasingly difficult to qualify for, numerous borrowers have turned toward government-backed FHA mortgages.Here are six major advantages to FHA loan financing which have contributed...

With so many advantages to the FHA program coupled with conventional loans becoming increasingly difficult to qualify for, numerous borrowers have turned toward government-backed FHA mortgages.Here are six major advantages to FHA loan financing which have contributed...

Qualifying for a Mortgage when Self-Employed

Self-employed and others without typical, W-2 incomes could find themselves having a hard time getting a home loan due to heavier regulations.. Because income can vary from year to year, business expenses are high, and there is no W-2, small businesses and the...

Self-employed and others without typical, W-2 incomes could find themselves having a hard time getting a home loan due to heavier regulations.. Because income can vary from year to year, business expenses are high, and there is no W-2, small businesses and the...

5 Ways to Get the Money for Your Down Payment

You likely don’t have access to established equity to fund the down payment on your new home if you're a first-time home buyer. However, there are ways around this obstacle.. 1. Adjust your budget and save. If you don’t have any money...

You likely don’t have access to established equity to fund the down payment on your new home if you're a first-time home buyer. However, there are ways around this obstacle.. 1. Adjust your budget and save. If you don’t have any money...

Finding the Best VA Lender

When a borrower is thinking about taking out a VA home loan, one of the most important pieces of the puzzle is selecting the right lender with whom he or she will be taking out the loan. . A home purchase is easily one of the biggest purchases a borrower can make. As a...

When a borrower is thinking about taking out a VA home loan, one of the most important pieces of the puzzle is selecting the right lender with whom he or she will be taking out the loan. . A home purchase is easily one of the biggest purchases a borrower can make. As a...

VA Hybrid ARM (Adjustable Mortgage)

The VA Hybrid ARM loan combines the qualities of both fixed and adjustable rate mortgages. . This mortgage begins as a fixed rate mortgage for the first 3, 5, 7, or 10 years with interest rates locked into place. Following this period, the mortgage becomes an adjustable...

The VA Hybrid ARM loan combines the qualities of both fixed and adjustable rate mortgages. . This mortgage begins as a fixed rate mortgage for the first 3, 5, 7, or 10 years with interest rates locked into place. Following this period, the mortgage becomes an adjustable...

Know Your Home Buyer and Borrower Rights

There are two primary acts that establish protections for real estate buyers and mortgage borrowers. Basic information about these acts is outlined below, along with a list of your rights as a first-time buyer and borrower.. The Fair Housing ActThe Fair Housing...

There are two primary acts that establish protections for real estate buyers and mortgage borrowers. Basic information about these acts is outlined below, along with a list of your rights as a first-time buyer and borrower.. The Fair Housing ActThe Fair Housing...

Getting A Home: Your Guide To Common Questions

Be informed about the home buying process! It's is the most empowering thing you can do, and Lender411 is definitely the right place to start!. Is Buying a Home For You?Many people have worries and concerns about the purchase of a home. Owning a home isn't for everyone,...

Be informed about the home buying process! It's is the most empowering thing you can do, and Lender411 is definitely the right place to start!. Is Buying a Home For You?Many people have worries and concerns about the purchase of a home. Owning a home isn't for everyone,...

8 Expenses to Expect When You Purchase Your Home

If you're a first time home buyer, you may not know what to expect when starting the home purchase process. You may know that it's generally a better financial move to buy a home than rent one. You may have decided you need additional space. You may be...

If you're a first time home buyer, you may not know what to expect when starting the home purchase process. You may know that it's generally a better financial move to buy a home than rent one. You may have decided you need additional space. You may be...

4 Ways HomePath Mortgage Helps Todays Home Buyers

Home buyers in the market right now have some tried-and-true mortgage loan options for financing a dream home, a first home or an investment home. One such option helps you buy a Fannie Mae owned property: HomePath Mortgage.. 1. Low down payment options. The down payment...

Home buyers in the market right now have some tried-and-true mortgage loan options for financing a dream home, a first home or an investment home. One such option helps you buy a Fannie Mae owned property: HomePath Mortgage.. 1. Low down payment options. The down payment...

Considerations for Building a Home

Project Future ProblemsWhen deciding neighborhood, homebuyers should be future-minded to rule out any possible deterrents to home buying. For example, even though the home has not yet been built, homebuyers can discuss with builders to make sure that sunlight will...

Project Future ProblemsWhen deciding neighborhood, homebuyers should be future-minded to rule out any possible deterrents to home buying. For example, even though the home has not yet been built, homebuyers can discuss with builders to make sure that sunlight will...

What is an Option ARM Loan?

An adjustable-rate mortgage has flexible mortgage payment options that help you to manage your monthly cash flow better. Its low introductory start rate allows for a low initial mortgage payment and low qualifying rates that enable you to qualify for more home.. The...

An adjustable-rate mortgage has flexible mortgage payment options that help you to manage your monthly cash flow better. Its low introductory start rate allows for a low initial mortgage payment and low qualifying rates that enable you to qualify for more home.. The...

Top 10 Myths About Mortgages

Both experienced and first-time home buyers can make the same mistake of selecting the wrong type of mortgage loan. Fail-proof your mortgage application process by reviewing this list of the Top 10 Myths about Mortgages:. Myth #1: The Lowest Rate is Always the Best ChoiceA...

Both experienced and first-time home buyers can make the same mistake of selecting the wrong type of mortgage loan. Fail-proof your mortgage application process by reviewing this list of the Top 10 Myths about Mortgages:. Myth #1: The Lowest Rate is Always the Best ChoiceA...

How to Buy a Home in the Spring Season

With the approach of spring comes the annual spring buying season, when home buyers flock to desirable neighborhoods and sellers experience the added benefits of a competitive market. With 2013 housing inventory continuously shrinking, sales are expected to be unusually...

With the approach of spring comes the annual spring buying season, when home buyers flock to desirable neighborhoods and sellers experience the added benefits of a competitive market. With 2013 housing inventory continuously shrinking, sales are expected to be unusually...

First Time Home Buyer Loans

When searching for a first time home buyer loan, you may be confused and filled with doubt or intimidation. Purchasing a home is a major financial decision, and it’s good that you’re not taking it lightly. . Finding Your New HomeOnce you...

When searching for a first time home buyer loan, you may be confused and filled with doubt or intimidation. Purchasing a home is a major financial decision, and it’s good that you’re not taking it lightly. . Finding Your New HomeOnce you...

Get a Mortgage with Bad Credit

If you are worried that bad credit will prevent you from being approved for the loan, a bad credit mortgage loan can be the solution. . Sub-prime mortgage loans were once a popular solution for those with a low FICO score before the housing crash. However, now there...

If you are worried that bad credit will prevent you from being approved for the loan, a bad credit mortgage loan can be the solution. . Sub-prime mortgage loans were once a popular solution for those with a low FICO score before the housing crash. However, now there...

Social Benefits of Homeownership

. Owning a home does not necessarily make anyone a better or happier person. However, recent research from the National Association of Realtors (NAR) shows notable correlations between social characteristics and owning a home that may point to the kind of stability...

. Owning a home does not necessarily make anyone a better or happier person. However, recent research from the National Association of Realtors (NAR) shows notable correlations between social characteristics and owning a home that may point to the kind of stability...

FHA Home Loans

FHA Loan AdvantagesMinimum down payment is 3.5% (escrow required).. Minimum credit score is 580.. No penalties for pre-payment of the loan.. Closing costs may be covered in the loan repayment.. Low interest rates are available, similar to conventional.. Short waiting period to...

FHA Loan AdvantagesMinimum down payment is 3.5% (escrow required).. Minimum credit score is 580.. No penalties for pre-payment of the loan.. Closing costs may be covered in the loan repayment.. Low interest rates are available, similar to conventional.. Short waiting period to...

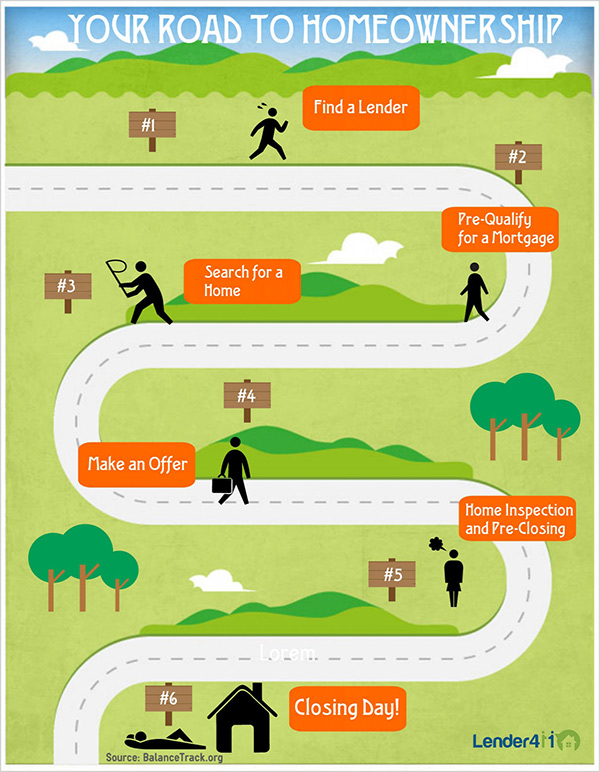

Infographic: Your Road to Homeownership

#1: Find a Lender.. Before you start the whole process of buying a home, you're going to need to find a reputable lender who will give you the home loan that will let you buy your home. Make sure to do your research and compare at least two or three lenders to see how they...

#1: Find a Lender.. Before you start the whole process of buying a home, you're going to need to find a reputable lender who will give you the home loan that will let you buy your home. Make sure to do your research and compare at least two or three lenders to see how they...

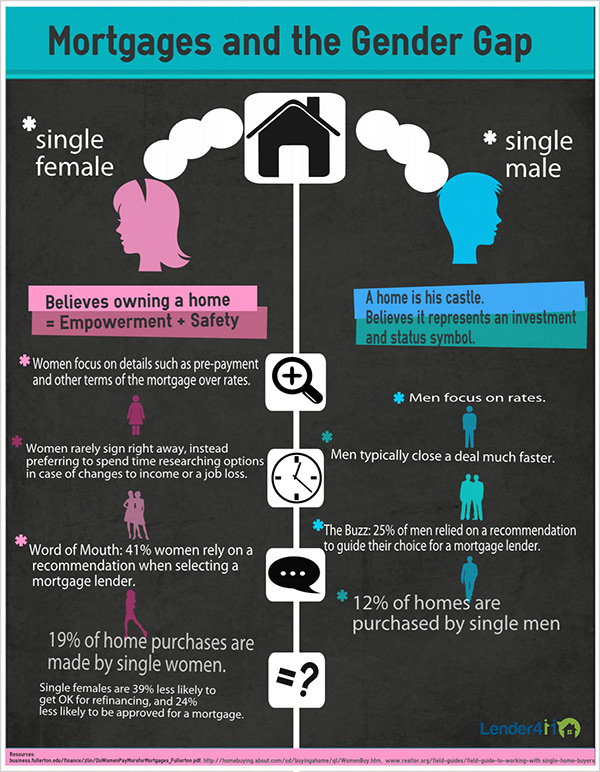

Infographic: Mortgages and the Gender Gap

This infographic examines the differences in mortgage and home buying practices between men and women. Women and men not only buy for different reasons, but they focus on different issues during the mortgage loan process. Check out this infographic to find out the stats..

This infographic examines the differences in mortgage and home buying practices between men and women. Women and men not only buy for different reasons, but they focus on different issues during the mortgage loan process. Check out this infographic to find out the stats..

Mortgage Rates 8-06-2013

Are mortgage rates going up or down tomorrow? For the most part, mortgage rates remained unchanged from yesterday to today. There were a few slight increases, but lenders hardly changed their rate sheets. Most likely, rates will continue to rise as markets are in a rising rate...

Are mortgage rates going up or down tomorrow? For the most part, mortgage rates remained unchanged from yesterday to today. There were a few slight increases, but lenders hardly changed their rate sheets. Most likely, rates will continue to rise as markets are in a rising rate...

Mortgage Rates 8-05-2013

Following the Employment Situation Report, mortgage rates took a turn for the better. Besides the FHA 30 Year Fixed Rate, all rates fell by at least 0.09 percentage points. This means that these rates have dropped signicantly below the 52 Week High. Even...

Following the Employment Situation Report, mortgage rates took a turn for the better. Besides the FHA 30 Year Fixed Rate, all rates fell by at least 0.09 percentage points. This means that these rates have dropped signicantly below the 52 Week High. Even...

Mortgage Rates 8-02-2013

It seems as if mortgage rates are slowly on the rise again, as evidenced by the fact that all rates rose at least 0.03 percentage points from yesterday besides the FHA 30 Year Fixed Rate. While these rates still have several percentage points to rise before reaching the 52 Week...

It seems as if mortgage rates are slowly on the rise again, as evidenced by the fact that all rates rose at least 0.03 percentage points from yesterday besides the FHA 30 Year Fixed Rate. While these rates still have several percentage points to rise before reaching the 52 Week...

Ask our community a question.

Get an answer

Related Articles

Featured Lenders

Lisa Stepp

RBS Citizens

Clifton Park, NY

Cameron Burke

Vision One Mortgage

Huntington Beach, CA

Kat Whitman

Whitman Met, Inc.

Sacramento, CA