Fha Mortgage Articles

What is an FHA Loan?

FHA loans are insured by the Federal Housing Administration. Since FHA guarantees to pay the balance in the event of a loan default, rather than the lender having to write it off, FHA loans are open to people with little to no credit history, poor credit history or to those...

FHA loans are insured by the Federal Housing Administration. Since FHA guarantees to pay the balance in the event of a loan default, rather than the lender having to write it off, FHA loans are open to people with little to no credit history, poor credit history or to those...

What is FHA MIP?

When taking out an FHA-insured loan, home buyers are required to pay a mandatory mortgage insurance premium (MIP). MIP protects the bank from taking a loss if a homeowner stops making their mortgage payments. It's insurance that gives the banks the ability...

When taking out an FHA-insured loan, home buyers are required to pay a mandatory mortgage insurance premium (MIP). MIP protects the bank from taking a loss if a homeowner stops making their mortgage payments. It's insurance that gives the banks the ability...

Benefits of FHA Mortgage Loans

An FHA mortgage can save you a lot of money on your home purchase and get you into a new home that much faster. Here's a brief recap of some of the most rewarding FHA loan benefits and what it has to offer. . Easier Qualification RequirementsThe biggest...

An FHA mortgage can save you a lot of money on your home purchase and get you into a new home that much faster. Here's a brief recap of some of the most rewarding FHA loan benefits and what it has to offer. . Easier Qualification RequirementsThe biggest...

Can I get an FHA Loan after Bankruptcy or Foreclosure?

For potential home buyers with bad credit, qualifying for a home loan can seem like a daunting task, especially if it's following a bankruptcy, foreclosure, or short sale. . FHA Loan After a BankruptcyMany people wonder if they can get an FHA home loan after a...

For potential home buyers with bad credit, qualifying for a home loan can seem like a daunting task, especially if it's following a bankruptcy, foreclosure, or short sale. . FHA Loan After a BankruptcyMany people wonder if they can get an FHA home loan after a...

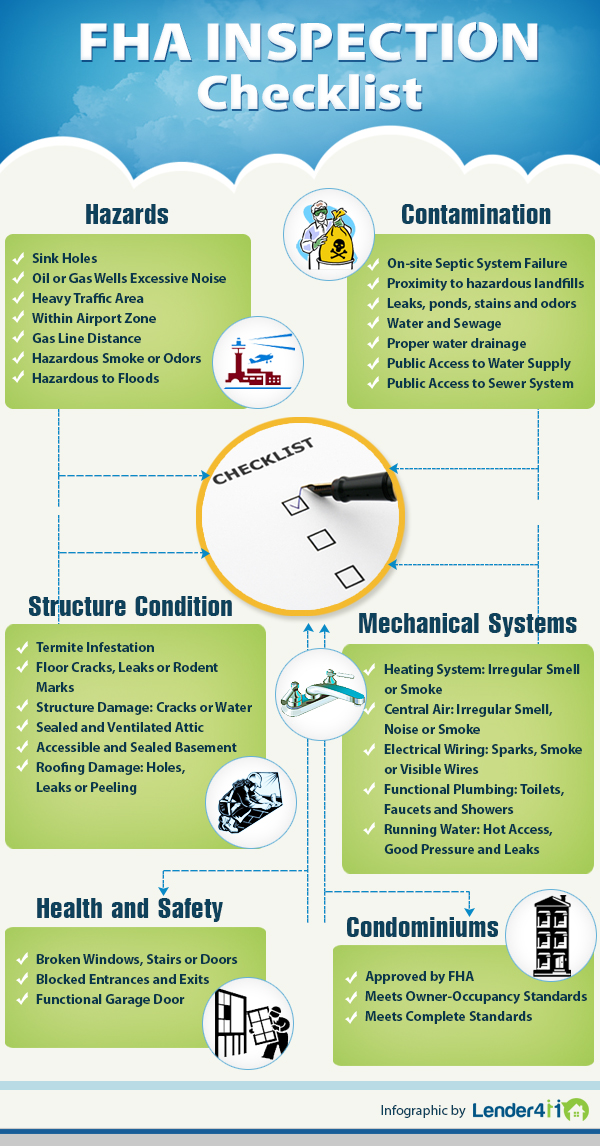

FHA Inspection Checklist

Qualifying for an FHA loan for your new home must first satisfy a strict FHA inspection, including criteria for health, safety, and security. These inspections are a supplement to the FHA-approved appraisal. . Use this FHA Inspection Checklist to familiarize yourself...

Qualifying for an FHA loan for your new home must first satisfy a strict FHA inspection, including criteria for health, safety, and security. These inspections are a supplement to the FHA-approved appraisal. . Use this FHA Inspection Checklist to familiarize yourself...

FHA Mortgage Insurance Refund

While loans insured by the Federal Housing Administration (FHA) include many beneficial qualities, borrowers securing FHA mortgages or FHA refinance loans pay high mortgage insurance charges, regardless of the down payment amount. . Divided into two fees, an...

While loans insured by the Federal Housing Administration (FHA) include many beneficial qualities, borrowers securing FHA mortgages or FHA refinance loans pay high mortgage insurance charges, regardless of the down payment amount. . Divided into two fees, an...

Benefits of FHA Streamline Refinance

Homeowners with mortgages insured by the Federal Housing Administration (FHA) have a unique refinance option, known as the FHA streamline refinance. Unlike the standard FHA refinance, the streamline variant requires significantly reduced up-front costs and...

Homeowners with mortgages insured by the Federal Housing Administration (FHA) have a unique refinance option, known as the FHA streamline refinance. Unlike the standard FHA refinance, the streamline variant requires significantly reduced up-front costs and...

Advantages of an FHA Loan

With so many advantages to the FHA program coupled with conventional loans becoming increasingly difficult to qualify for, numerous borrowers have turned toward government-backed FHA mortgages.Here are six major advantages to FHA loan financing which have contributed...

With so many advantages to the FHA program coupled with conventional loans becoming increasingly difficult to qualify for, numerous borrowers have turned toward government-backed FHA mortgages.Here are six major advantages to FHA loan financing which have contributed...

Requirements for FHA Streamline Refinance

You must have an FHA loan to be eligible for an FHA Streamline Refinance.. Other requirements include the following.. You must be current on your mortgage paymentsYou can't have had any late payments in the past three monthsYou can't have had any more than one late...

You must have an FHA loan to be eligible for an FHA Streamline Refinance.. Other requirements include the following.. You must be current on your mortgage paymentsYou can't have had any late payments in the past three monthsYou can't have had any more than one late...

Everything You Need to Know About the FHA Home Appraisal

The Federal Housing Administration, or FHA, requires licensed appraisers to both value and inspect homes in order to price and identify immediate concerns with the house. The appraiser compiles a list of necessary repairs to bring the house up to FHA's minimum...

The Federal Housing Administration, or FHA, requires licensed appraisers to both value and inspect homes in order to price and identify immediate concerns with the house. The appraiser compiles a list of necessary repairs to bring the house up to FHA's minimum...

FHA Home Loans

FHA Loan AdvantagesMinimum down payment is 3.5% (escrow required).. Minimum credit score is 580.. No penalties for pre-payment of the loan.. Closing costs may be covered in the loan repayment.. Low interest rates are available, similar to conventional.. Short waiting period to...

FHA Loan AdvantagesMinimum down payment is 3.5% (escrow required).. Minimum credit score is 580.. No penalties for pre-payment of the loan.. Closing costs may be covered in the loan repayment.. Low interest rates are available, similar to conventional.. Short waiting period to...

FHA Streamline Refinance

If you currently have an FHA mortgage and would like to refinance your mortgage loan, the FHA streamline refinance loan program was created specifically for you. . This time-saving mortgage refinance program is the easiest way a homeowner with an FHA mortgage can...

If you currently have an FHA mortgage and would like to refinance your mortgage loan, the FHA streamline refinance loan program was created specifically for you. . This time-saving mortgage refinance program is the easiest way a homeowner with an FHA mortgage can...

Conventional Versus FHA Loans

This page describes two of the most popular loan types: conventional mortgage loans and FHA mortgage loans. To determine which loan best suits your circumstances, take some time to consider the pros and cons of each.. FHA vs. Conventional...

This page describes two of the most popular loan types: conventional mortgage loans and FHA mortgage loans. To determine which loan best suits your circumstances, take some time to consider the pros and cons of each.. FHA vs. Conventional...

Making a Mortgage Decision: Conventional, FHA and VA Home Loans

The three major loan program categories are conventional mortgages, FHA mortgages, and VA mortgages. Consider the following advantages and disadvantages of each to see which one is best for you:. Conventional MortgagesAny home loan not insured or guaranteed by the...

The three major loan program categories are conventional mortgages, FHA mortgages, and VA mortgages. Consider the following advantages and disadvantages of each to see which one is best for you:. Conventional MortgagesAny home loan not insured or guaranteed by the...

FHA Loans for First Time Home Buyers

FHA Loans are a popular choice with many first time buyers. FHA loans remain easier to get and offer some advantages in comparison to conventional mortgages. As long as you do not have an existing FHA mortgage and you meet the following minimum requirements, you...

FHA Loans are a popular choice with many first time buyers. FHA loans remain easier to get and offer some advantages in comparison to conventional mortgages. As long as you do not have an existing FHA mortgage and you meet the following minimum requirements, you...

FHA Approved Condo Eligibility

You should always consider whether or not the property is FHA-approved when purchasing a property. The FHA will only allow borrowers to apply funds from an FHA loan toward homes that have been approved. . Consequently, condo owners with properties not approved by...

You should always consider whether or not the property is FHA-approved when purchasing a property. The FHA will only allow borrowers to apply funds from an FHA loan toward homes that have been approved. . Consequently, condo owners with properties not approved by...

FHA Approved Condominiums

FHA Approved Condominums are great for first time homebuyers. Many borrowers, especially first time home buyers look to FHA because the requirements are much friendlier to qualify than a conventional loan. These borrowers usually opt for an FHA loan, which allows...

FHA Approved Condominums are great for first time homebuyers. Many borrowers, especially first time home buyers look to FHA because the requirements are much friendlier to qualify than a conventional loan. These borrowers usually opt for an FHA loan, which allows...

What Is an FHA 203k Loan?

The FHA 203k loan is a variation of the Federal Housing Authority-insured loan, commonly known as an FHA loan. The Section 203k program is the Federal Housing Authority's primary program for rehabilitating single-family homes and is an important means of community...

The FHA 203k loan is a variation of the Federal Housing Authority-insured loan, commonly known as an FHA loan. The Section 203k program is the Federal Housing Authority's primary program for rehabilitating single-family homes and is an important means of community...

Everything You Need to Know About the FHA Home Appraisal

The Federal Housing Administration, or FHA, requires licensed appraisers to both value and inspect homes in order to price and identify immediate concerns with the house. The appraiser compiles a list of necessary repairs to bring the house up to FHA's minimum...

The Federal Housing Administration, or FHA, requires licensed appraisers to both value and inspect homes in order to price and identify immediate concerns with the house. The appraiser compiles a list of necessary repairs to bring the house up to FHA's minimum...

FHA 203k Home Improvement Projects

Recent data from the National Association of Realtors (NAR) show that within 90 days of buying a home, 53% percent of new homeowners begin a home improvement project. 37% also purchase new appliances.. While the idea of personalizing your home new improvements and new...

Recent data from the National Association of Realtors (NAR) show that within 90 days of buying a home, 53% percent of new homeowners begin a home improvement project. 37% also purchase new appliances.. While the idea of personalizing your home new improvements and new...

President Obama Initiates Lower FHA Mortgage Insurance Premiums

President Obama recently announced that he intends to lower mortgage insurance premiums as much as half a percentage point on select FHA issued mortgages. This change could potentially allow as many as 250,000 people to become first time homebuyers in the next year...

President Obama recently announced that he intends to lower mortgage insurance premiums as much as half a percentage point on select FHA issued mortgages. This change could potentially allow as many as 250,000 people to become first time homebuyers in the next year...

Infographic: FHA Inspection Checklist

FHA provides great loan options for your new home. Your desired property will require an inspection in order to determine eligibility.To ensure you qualify, be prepared with the following FHA inspection checklist and prevent potential pitfalls. Need details? Check out our...

FHA provides great loan options for your new home. Your desired property will require an inspection in order to determine eligibility.To ensure you qualify, be prepared with the following FHA inspection checklist and prevent potential pitfalls. Need details? Check out our...