Mortgage Tips Articles

How to Pay Off a Mortgage Early

This article will cover four ways to pay off a mortgage early, beginning with the simplest solution and ending with the most complicated solution. All these strategies can be beneficial when correctly utilized, but each method varies in risk and feasibility,...

This article will cover four ways to pay off a mortgage early, beginning with the simplest solution and ending with the most complicated solution. All these strategies can be beneficial when correctly utilized, but each method varies in risk and feasibility,...

Financial Advice for Recent College Graduates

. Whether you are one of the lucky graduates starting the summer with your first professional job or are moving home to live with the ‘rents while searching for that perfect job opportunity, it’s important to be realistic about your financial situation. ....

. Whether you are one of the lucky graduates starting the summer with your first professional job or are moving home to live with the ‘rents while searching for that perfect job opportunity, it’s important to be realistic about your financial situation. ....

How to Buy a Home in the Spring Season

With the approach of spring comes the annual spring buying season, when home buyers flock to desirable neighborhoods and sellers experience the added benefits of a competitive market. With 2013 housing inventory continuously shrinking, sales are expected to be unusually...

With the approach of spring comes the annual spring buying season, when home buyers flock to desirable neighborhoods and sellers experience the added benefits of a competitive market. With 2013 housing inventory continuously shrinking, sales are expected to be unusually...

6 Helpful Tips for Getting a Mortgage While Self-Employed

If you are self-employed and have excellent credit and a significant down payment you still may not qualify for a mortgage due to recent changes in industry regulations. . Most lenders consider the self-employed to be riskier than their W-2 wage earning counterparts...

If you are self-employed and have excellent credit and a significant down payment you still may not qualify for a mortgage due to recent changes in industry regulations. . Most lenders consider the self-employed to be riskier than their W-2 wage earning counterparts...

Shrink Your Mortgage With the Bi-Monthly Payment Program

Bi-monthly mortgage payments are a great alternative to shorten the duration of your mortgage without the expense of refinancing your house to a shorter term. . The concept of the bi-monthly mortgage payment is simple: by paying half of your mortgage payment every two...

Bi-monthly mortgage payments are a great alternative to shorten the duration of your mortgage without the expense of refinancing your house to a shorter term. . The concept of the bi-monthly mortgage payment is simple: by paying half of your mortgage payment every two...

What Is a Mortgage Payment?

A monthly mortgage payment is an amount that's paid on a mortgage loan each month. . Depending on whether you have a fixed or adjustable rate mortgage (ARM), your mortgage payment may be set to a specific amount each month, or it may adjust periodically based on market...

A monthly mortgage payment is an amount that's paid on a mortgage loan each month. . Depending on whether you have a fixed or adjustable rate mortgage (ARM), your mortgage payment may be set to a specific amount each month, or it may adjust periodically based on market...

Mortgage Refinance Tips

Refinancing your mortgage is an excellent way to reduce your monthly mortgage payment and create additional cash flow for savings or other pursuits. Weigh your options to see if a refinance makes sense for your financial situation. . Start your decision-making process...

Refinancing your mortgage is an excellent way to reduce your monthly mortgage payment and create additional cash flow for savings or other pursuits. Weigh your options to see if a refinance makes sense for your financial situation. . Start your decision-making process...

Mortgage Fees You Can Avoid

Plugging numbers into a mortgage calculator is easy—deciphering the results is not. Consider the following fees during your search for the right mortgage broker. . Origination fees:This is the originator’s commission for securing the loan. Ask what...

Plugging numbers into a mortgage calculator is easy—deciphering the results is not. Consider the following fees during your search for the right mortgage broker. . Origination fees:This is the originator’s commission for securing the loan. Ask what...

What You Need To Know About Escrow

. When you purchase or refinance your home, you will receive a GFE (good faith estimate) from your lawyer approximately when you will go into escrow. This GFE will describe in detail the information for your escrow account; this is commonly referred to as insurance...

. When you purchase or refinance your home, you will receive a GFE (good faith estimate) from your lawyer approximately when you will go into escrow. This GFE will describe in detail the information for your escrow account; this is commonly referred to as insurance...

7 Sins of First Time Home Buyers

First time home buyers beware; purchasing a home is a serious and long term financial investment.. Knowing what dangerous mistakes to avoid can mean the difference between digging your own grave of debt and creating a secure financial future.. Read the following 7 Sins of First...

First time home buyers beware; purchasing a home is a serious and long term financial investment.. Knowing what dangerous mistakes to avoid can mean the difference between digging your own grave of debt and creating a secure financial future.. Read the following 7 Sins of First...

Notable Features of Construction to Permanent Home Loans

A construction-to-permanent loan is a type of loan that converts to a mortgage after originating as a construction loan. This type of loan is perfect for home buyers who are building a new house because many people don’t have the required financing to obtain...

A construction-to-permanent loan is a type of loan that converts to a mortgage after originating as a construction loan. This type of loan is perfect for home buyers who are building a new house because many people don’t have the required financing to obtain...

3 Things You Should Know Before You Switch Mortgage Lenders

Are you considering switching or trading mortgage lenders? You're not alone. Many homeowners decide to refinance their existing mortgage using a different mortgage lender. . Often, switching to a new mortgage lender means lower mortgage rates and more favorable...

Are you considering switching or trading mortgage lenders? You're not alone. Many homeowners decide to refinance their existing mortgage using a different mortgage lender. . Often, switching to a new mortgage lender means lower mortgage rates and more favorable...

How to Select a Mortgage Lender

We’ve developed a comprehensive guide that will help you select the best mortgage lender to close your home loan. But before we get into the steps you’ll need to take, let’s identify some of the attributes of a good lender.. Identifying a Good LenderA...

We’ve developed a comprehensive guide that will help you select the best mortgage lender to close your home loan. But before we get into the steps you’ll need to take, let’s identify some of the attributes of a good lender.. Identifying a Good LenderA...

Your Cheat Sheet to Short Sale Guidelines

In November 2012, the FHFA announced that both Freddie Mac and Fannie Mae were implementing new short sale guidelines for mortgage servicers. In essence, these updated guidelines fused all existing short sale programs into one unified program. . Under the new...

In November 2012, the FHFA announced that both Freddie Mac and Fannie Mae were implementing new short sale guidelines for mortgage servicers. In essence, these updated guidelines fused all existing short sale programs into one unified program. . Under the new...

What Do I Need To Know About Private Mortgage Insurance?

Although PMI (mortgage insurance) may not be the most popular form of insurance for some homeowners, for many, it's a must.. Thousands of hopeful homeowners are unable to afford the hefty 20 percent down payment, making PMI a useful foot-in-the-door, allowing for home...

Although PMI (mortgage insurance) may not be the most popular form of insurance for some homeowners, for many, it's a must.. Thousands of hopeful homeowners are unable to afford the hefty 20 percent down payment, making PMI a useful foot-in-the-door, allowing for home...

7 Tips for Selling Your Home in a Down Market

We have spoken with many real estate agents and learned their secrets to selling your house in a short amount of time without usually having to change the offering price.. 1. Get a professional appraisal. Getting a professional appraiser to evaluate your home allows you to...

We have spoken with many real estate agents and learned their secrets to selling your house in a short amount of time without usually having to change the offering price.. 1. Get a professional appraisal. Getting a professional appraiser to evaluate your home allows you to...

How Can I Avoid The Home Equity Trap?

For Americans nearing retirement: Do you stick to your original plan of selling your home and living off the profit despite the increased capital gains tax will consume a significant portion of the profit? . Factor in the new 3.8 percent Medicare tax, and suddenly the...

For Americans nearing retirement: Do you stick to your original plan of selling your home and living off the profit despite the increased capital gains tax will consume a significant portion of the profit? . Factor in the new 3.8 percent Medicare tax, and suddenly the...

What Is Mortgage Escrow?

Mortgage escrow accounts let borrowers build up money for homeowners’ policy premiums and property taxes gradually. Escrow accounts are suggested for first time home buyers because buyers will be able to avoid surprises such as missed payments. Lenders often...

Mortgage escrow accounts let borrowers build up money for homeowners’ policy premiums and property taxes gradually. Escrow accounts are suggested for first time home buyers because buyers will be able to avoid surprises such as missed payments. Lenders often...

Adding a Balloon Payment to an Owner Financed Note

Should you add a balloon mortgage payment to your note? . It can improve the value of the note, so it may not be a bad idea. However, it can be a dangerous decision. Read on to learn how to reduce the risks associated with this type of mortgage note addition.. Any of the factors...

Should you add a balloon mortgage payment to your note? . It can improve the value of the note, so it may not be a bad idea. However, it can be a dangerous decision. Read on to learn how to reduce the risks associated with this type of mortgage note addition.. Any of the factors...

Reasons to get an Adjustable-Rate Mortgage

Rising mortgage interest rates are inspiring many prospective homebuyers to explore alternatives to fixed-rate mortgages. If you are looking for an alternative to a fixed-rate mortgage, you may want to consider an adjustable-rate mortgage. An adjustable-rate...

Rising mortgage interest rates are inspiring many prospective homebuyers to explore alternatives to fixed-rate mortgages. If you are looking for an alternative to a fixed-rate mortgage, you may want to consider an adjustable-rate mortgage. An adjustable-rate...

Infographic: Don't Wait To Buy

This infographic illustrates the affect mortgage interest rates have on monthly mortgage payments. The example demonstrates a 30-year fixed-rate mortgage at $250,000 and the subsequent effect an increase in interest rates will have on monthly payments..

This infographic illustrates the affect mortgage interest rates have on monthly mortgage payments. The example demonstrates a 30-year fixed-rate mortgage at $250,000 and the subsequent effect an increase in interest rates will have on monthly payments..

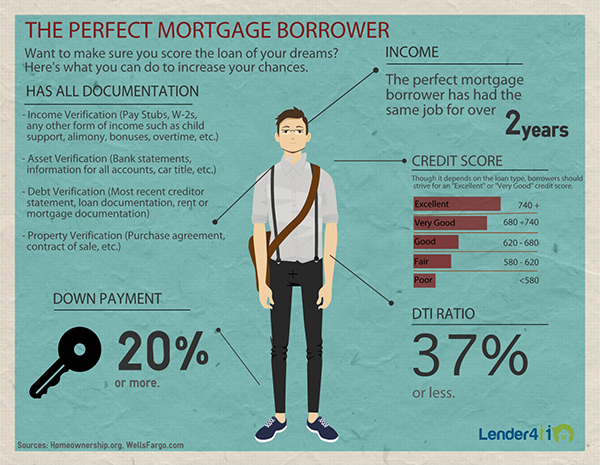

Infographic: The Perfect Mortgage Borrower

This infographic details the qualifications of the perfect mortgage borrower. To increase your chances of locking in your ideal mortgage loan, ensure you meet the following requirements. You will need to have had the same job for 2 years, a down payment of 20%, a DTI Ratio of 37%...

This infographic details the qualifications of the perfect mortgage borrower. To increase your chances of locking in your ideal mortgage loan, ensure you meet the following requirements. You will need to have had the same job for 2 years, a down payment of 20%, a DTI Ratio of 37%...

Ask our community a question.

Get an answer

Related Articles

Featured Lenders

Lisa Stepp

RBS Citizens

Clifton Park, NY

Cameron Burke

Vision One Mortgage

Huntington Beach, CA

Kat Whitman

Whitman Met, Inc.

Sacramento, CA