The Credit Block

By Gretchen Wegrich Updated on 4/24/2013In a Mostly Favorable Market, Homebuyers Limited by Low Credit

By Gretchen Wegrich

With the housing market showing steady improvement during the opening months of 2013, a recent report from CoreLogic revealed that the housing industry could be further strengthened by several factors, while homebuyers struggle to overcome major obstacles on the path to homeownership.

In today’s market, sellers must grapple with not owning sufficient equity in their homes to make a significant downpayment on a home in a housing market that favors the seller. In addition, sellers need to have strong enough credit to qualify for a mortgage in today’s tight lending industry.

Many of the markets that were slammed by the collapse of the housing industry are seeing strong year-over-year improvement, allowing homeowners to build up sufficient equity to sell. With enough equity in their homes, homeowners are putting their homes on the market and enjoying the benefits of a tight housing inventory, reports CoreLogic, then entering the market as buyers once their home sells.

Yet another positive effect is that the growing equity is boosting trade-up buyer demand, fueling a healthy housing cycle.

Investor activity is also increasing in response to homeowners’ expanding equity. Investor activity is anticipated to continue propelling demand through 2013.

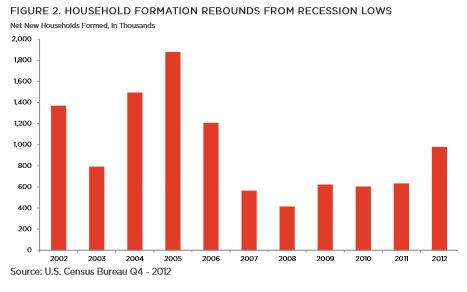

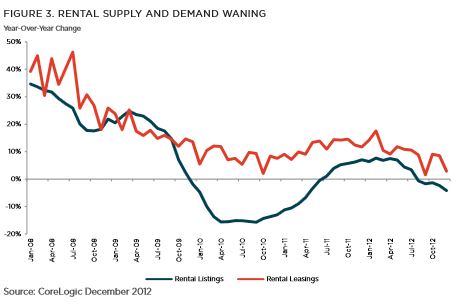

First-time home buyer activity is also predicted to grow, reported CoreLogic. While the recession caused a hiccup in new household formation as many people doubled-up on their living arrangements and young people moved back in with their parents, today’s household formation is again driving rental demand and elevating the cost of renting.

The current cycle of new household formation is pushing many first-time buyers away from rentals.

“As new renter-households are formed, rental prices are bid up, making the prospect of owning more attractive to existing renters,” wrote the author of the CoreLogic report, Mark Fleming.

During the spring homebuying season, Fleming expects more renters to take advantage of low interest rates and low home prices and make the move to become first-time homebuyers.

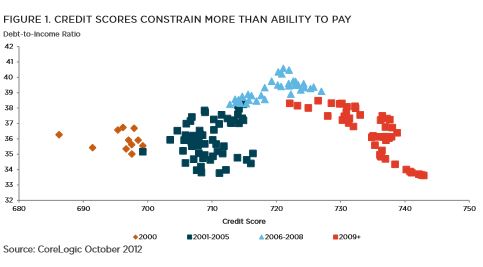

With the gradually improving economy buoyed by the housing sector, rising equity is removing a major obstacle to homeownership for many. However, creditworthiness remains a serious potential obstacle for many home buyers.

View the complete CoreLogic report.

Didn't find the answer you wanted? Ask one of your own.

-

What You Need To Know About Escrow

View More

What You Need To Know About Escrow

View More

-

President Obama Initiates Lower FHA Mortgage Insurance Premiums

View More

President Obama Initiates Lower FHA Mortgage Insurance Premiums

View More

-

What is Quantitative Easing?

View More

What is Quantitative Easing?

View More

-

The 5 New Mortgage and Housing Trends for Summer 2013

View More

The 5 New Mortgage and Housing Trends for Summer 2013

View More

-

Fannie Mae profitability skyrockets

View More

Fannie Mae profitability skyrockets

View More

-

Foreclosure protections for more soldiers after lawmakers draft bill

View More

Foreclosure protections for more soldiers after lawmakers draft bill

View More

-

FHFA: HARP success follows low mortgage rates, February refinance volume strong

View More

FHFA: HARP success follows low mortgage rates, February refinance volume strong

View More

-

Use of Mortgage Interest Deduction Depends on Where You Live

View More

Use of Mortgage Interest Deduction Depends on Where You Live

View More

-

HUD will sell 40,000 distressed loans in 2013

View More

HUD will sell 40,000 distressed loans in 2013

View More

-

Mortgage Principal Reduction Could Save Taxpayers $2.8 Billion

View More

Mortgage Principal Reduction Could Save Taxpayers $2.8 Billion

View More

-

Mortgage Applications Regain Traction after Sluggishness, Rates Continue to Fall

View More

Mortgage Applications Regain Traction after Sluggishness, Rates Continue to Fall

View More

-

HARP 3.0 Discussions Reveal Little Hope for HARP Update

View More

HARP 3.0 Discussions Reveal Little Hope for HARP Update

View More

-

Home Prices Rise in February According to LPS Data

View More

Home Prices Rise in February According to LPS Data

View More

-

Balancing Act: House Committee Hears Opposing Viewpoints Over Mortgage Interest Rate Deduction

View More

Balancing Act: House Committee Hears Opposing Viewpoints Over Mortgage Interest Rate Deduction

View More

-

Near Record Low Mortgage Rates Buoy Housing Recovery

View More

Near Record Low Mortgage Rates Buoy Housing Recovery

View More

Related Articles

Ask our community a question.

Searching Today's Rates...

Featured Lenders

Cameron Burke

Vision One Mortgage

Huntington Beach, CA

Kat Whitman

Whitman Met, Inc.

Sacramento, CA

Lisa Stepp

RBS Citizens

Clifton Park, NY