Infographics Articles

Infographic: Fast Ways to Boost Your Credit Score

If you're in need of a sooner-rather-than-later fix, these 7 tips for how to quickly boost your credit score may help. Whether you're looking to get approved for a mortgage loan, qualify for a car loan - whatever your need - our advice will get the job done in days, rather...

If you're in need of a sooner-rather-than-later fix, these 7 tips for how to quickly boost your credit score may help. Whether you're looking to get approved for a mortgage loan, qualify for a car loan - whatever your need - our advice will get the job done in days, rather...

Infographic: How Would Federal Tapering Affect me?

Federal Tapering has been begun, albeit slowly. This infographic illustrates how Tapering off Mortgage-Backed Securities at 45 billion each month, would directly affect you and the housing market..

Federal Tapering has been begun, albeit slowly. This infographic illustrates how Tapering off Mortgage-Backed Securities at 45 billion each month, would directly affect you and the housing market..

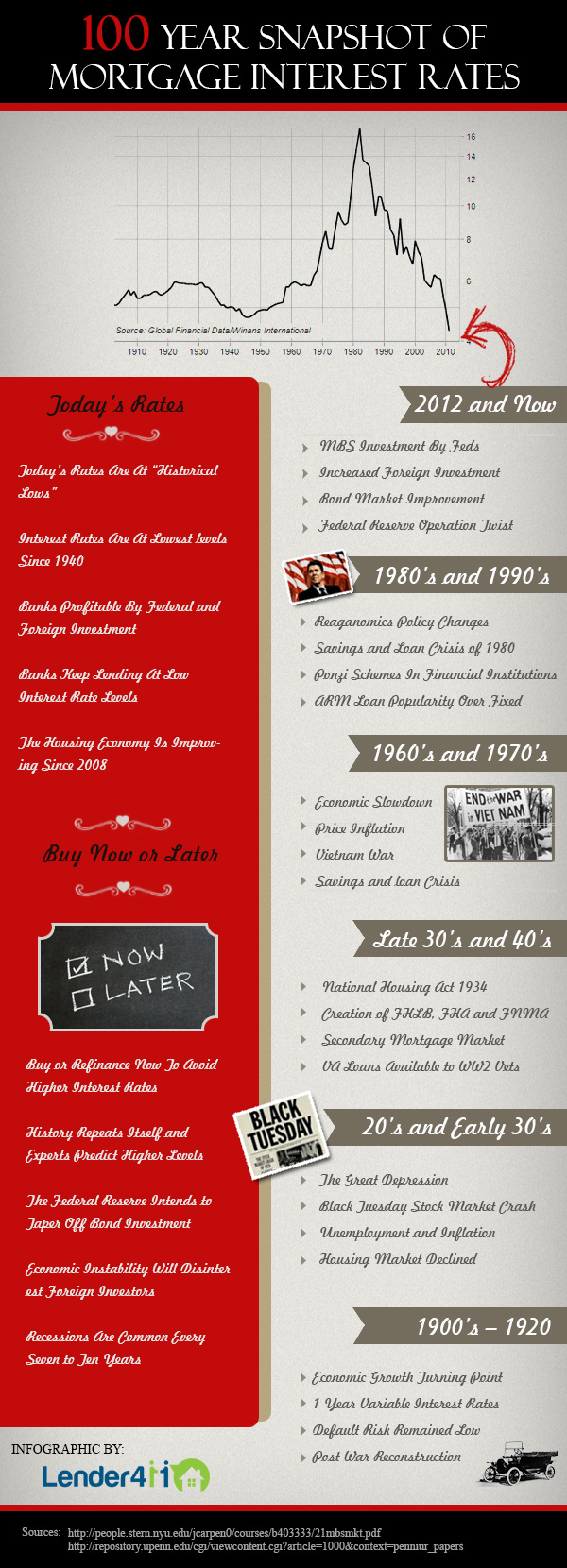

Infographic: 100 Year Snapshot of Mortgage Interest Rates

Today's mortgage interest rates are at historic lows. Market rates have not been this low since the 1940's. This infographic illustrates the last 100 years of market movement and the corresponding historical events that led to significant lows and highs in the...

Today's mortgage interest rates are at historic lows. Market rates have not been this low since the 1940's. This infographic illustrates the last 100 years of market movement and the corresponding historical events that led to significant lows and highs in the...

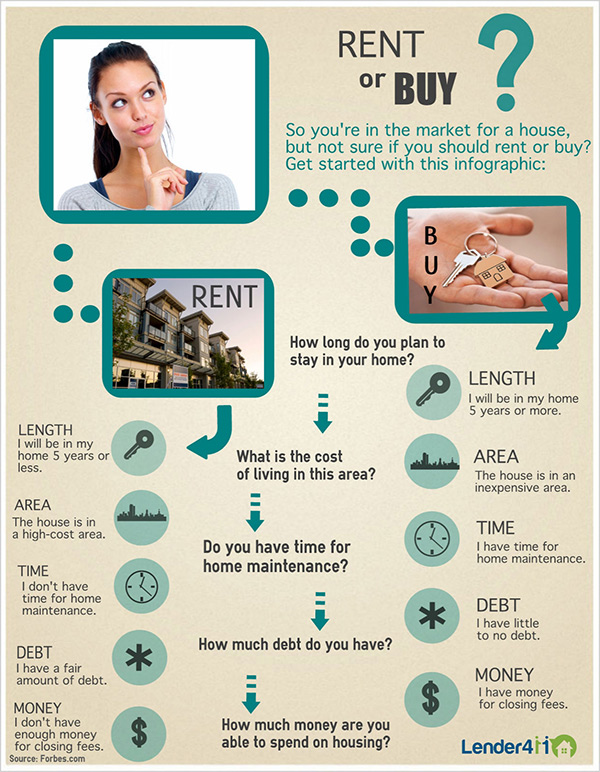

Infographic: Rent or Buy?

Still not sure? 90% of mortgage professionals voted you should buy. Interest rates are at historic lows, but not for long as the Feds will cut down investment. Lowest interest rates since the 1940's. Click Here to see!.

Still not sure? 90% of mortgage professionals voted you should buy. Interest rates are at historic lows, but not for long as the Feds will cut down investment. Lowest interest rates since the 1940's. Click Here to see!.

Infographic: Should I Refinance My Mortgage

How low can your monthly payment get? See for yourself with our free, personalized refinance quotes. Have a question? Ask our mortgage professionals an annoymous question!.

How low can your monthly payment get? See for yourself with our free, personalized refinance quotes. Have a question? Ask our mortgage professionals an annoymous question!.

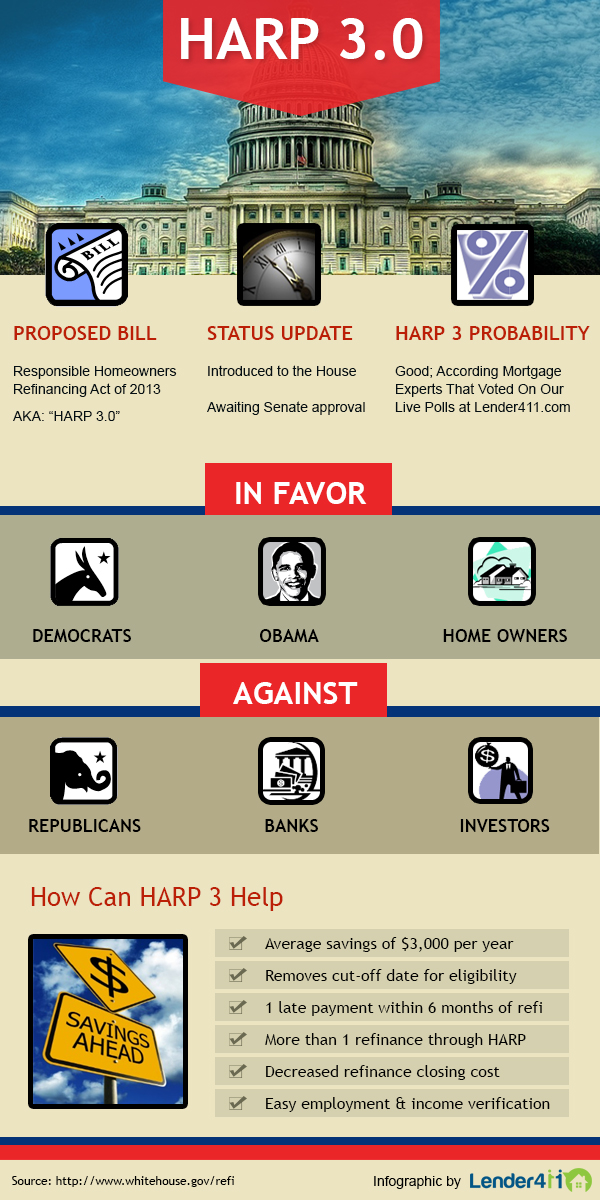

Infographic: HARP 3.0

Want to lower your house payment? HARP refinance is your best option. This government assisted refinance option allows you to modify your current loan to lower interest rates. HARP 3.0 is a revision to the current program, which includes a decrease in restrictions for...

Want to lower your house payment? HARP refinance is your best option. This government assisted refinance option allows you to modify your current loan to lower interest rates. HARP 3.0 is a revision to the current program, which includes a decrease in restrictions for...

Infographic: 401K For Down Payment

Saving for a down payment on your first home? Save yourself the trouble and borrow from yourself. Your 401K is a great source of immediate cash for your down payment. Learn about it with this infographic..

Saving for a down payment on your first home? Save yourself the trouble and borrow from yourself. Your 401K is a great source of immediate cash for your down payment. Learn about it with this infographic..

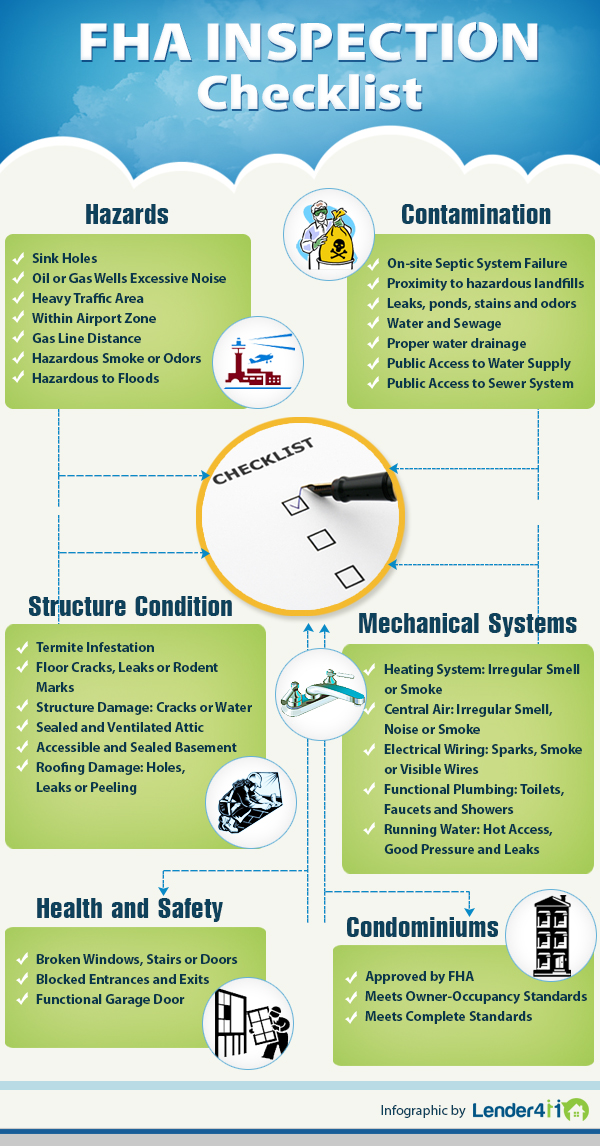

Infographic: FHA Inspection Checklist

FHA provides great loan options for your new home. Your desired property will require an inspection in order to determine eligibility.To ensure you qualify, be prepared with the following FHA inspection checklist and prevent potential pitfalls. Need details? Check out our...

FHA provides great loan options for your new home. Your desired property will require an inspection in order to determine eligibility.To ensure you qualify, be prepared with the following FHA inspection checklist and prevent potential pitfalls. Need details? Check out our...

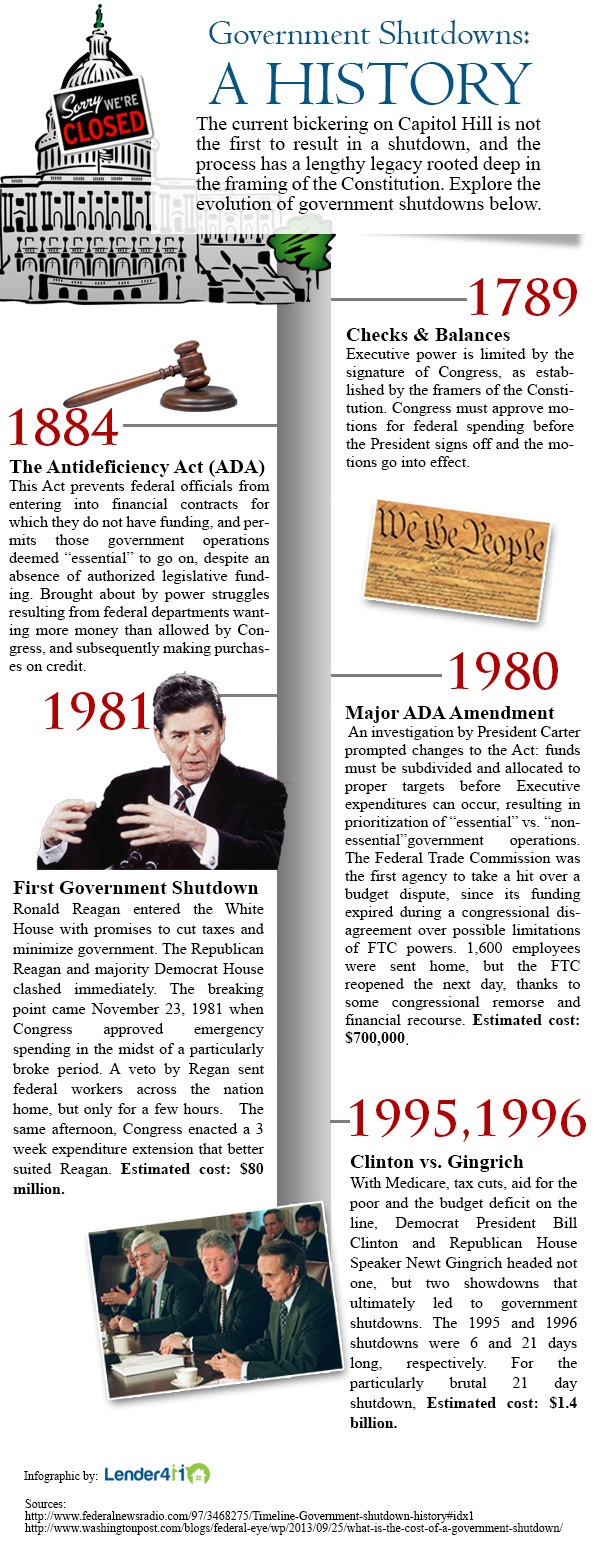

Infographic: Government Shutdowns Timeline

The current bickering on Capitol Hill is not the first to result in a shutdown, and the process has a lengthy legacy rooted deep in the framing of the Constitution..

The current bickering on Capitol Hill is not the first to result in a shutdown, and the process has a lengthy legacy rooted deep in the framing of the Constitution..

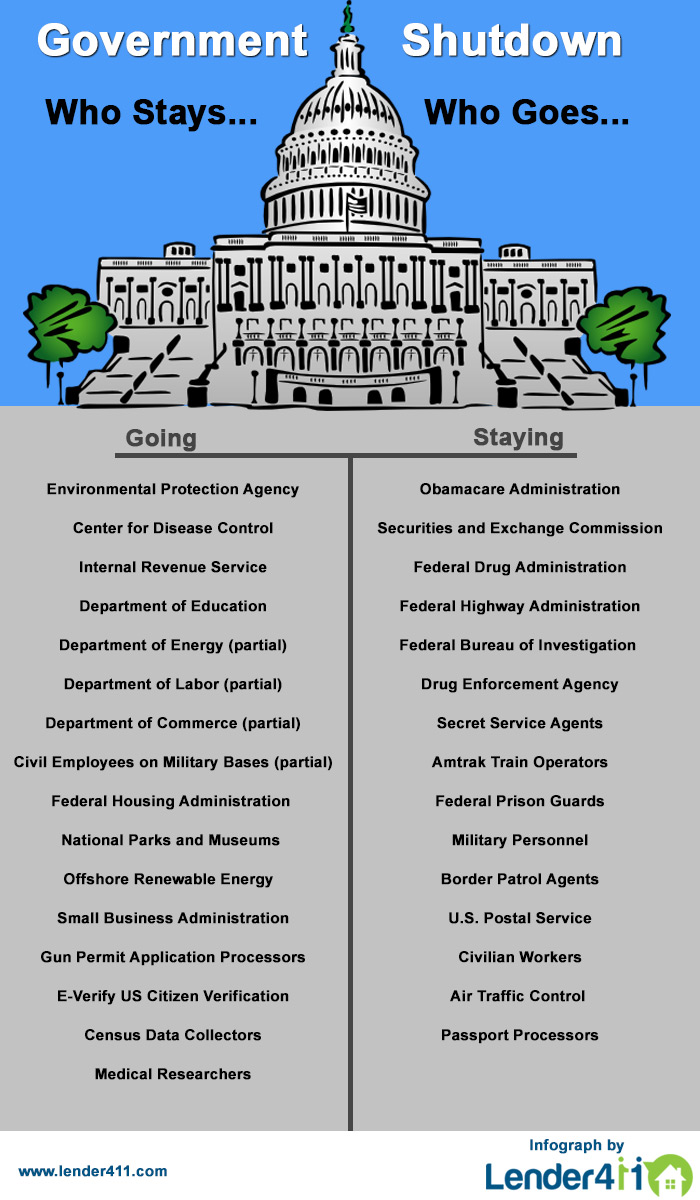

Infographic: Government Shutdown - Who Stays and Who Goes?

The #GovernmentShutdown begins today, October 1st 2013. This infographic details the areas of the government that are out of operation until the furlough period ends..

The #GovernmentShutdown begins today, October 1st 2013. This infographic details the areas of the government that are out of operation until the furlough period ends..

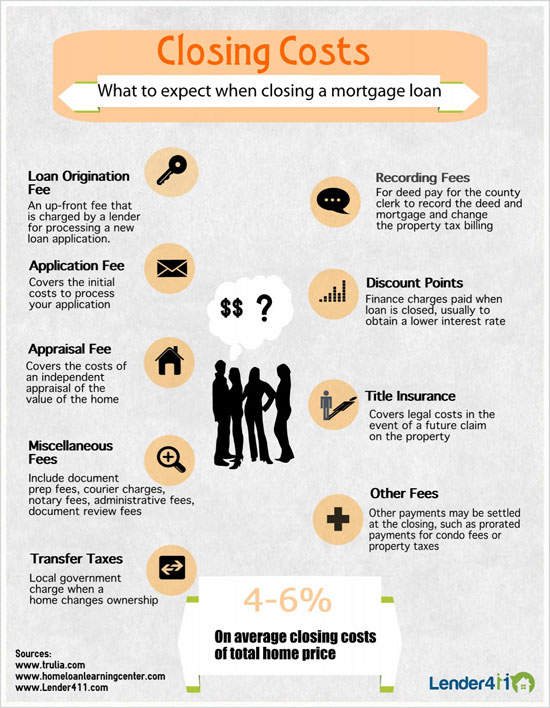

Infographic: Closing Costs

This infographic illustrates the closing costs associated with borrowing a loan. Closing costs include the origination fee, application fee, appraisal fee, transfer tax, title insurance, discount points and other miscelaneous fees. Closing costs on average are...

This infographic illustrates the closing costs associated with borrowing a loan. Closing costs include the origination fee, application fee, appraisal fee, transfer tax, title insurance, discount points and other miscelaneous fees. Closing costs on average are...

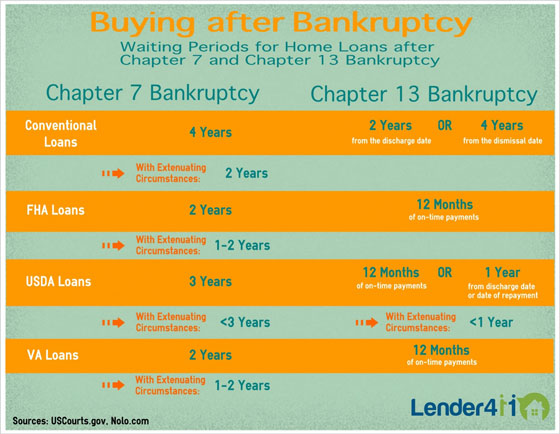

Infographic: Buying After Bankruptcy

Buying after bankruptcy? This infographic has everything you need to know about the waiting periods for each loan program. This illustrates the differences dependent upon filing a chapter 7 or chapter 13 bankruptcy..

Buying after bankruptcy? This infographic has everything you need to know about the waiting periods for each loan program. This illustrates the differences dependent upon filing a chapter 7 or chapter 13 bankruptcy..

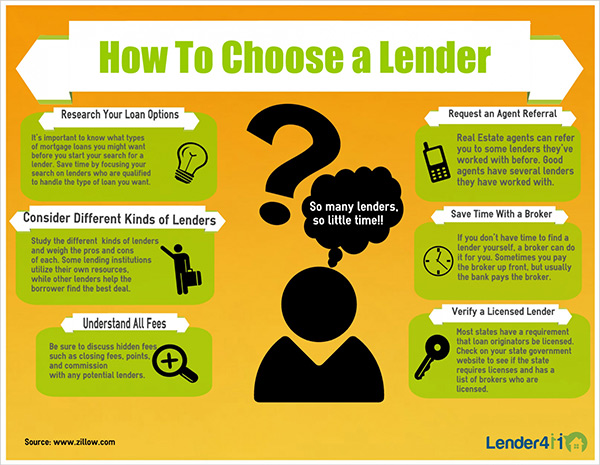

Infographic: How to Choose a Lender

How do I choose a lender? This infographic will guide you through the process of selecting a lender that's right for you. Begin with researching your loan options and kinds of lender, while educating yourself on the fees associated. You may want to request an agent referral...

How do I choose a lender? This infographic will guide you through the process of selecting a lender that's right for you. Begin with researching your loan options and kinds of lender, while educating yourself on the fees associated. You may want to request an agent referral...

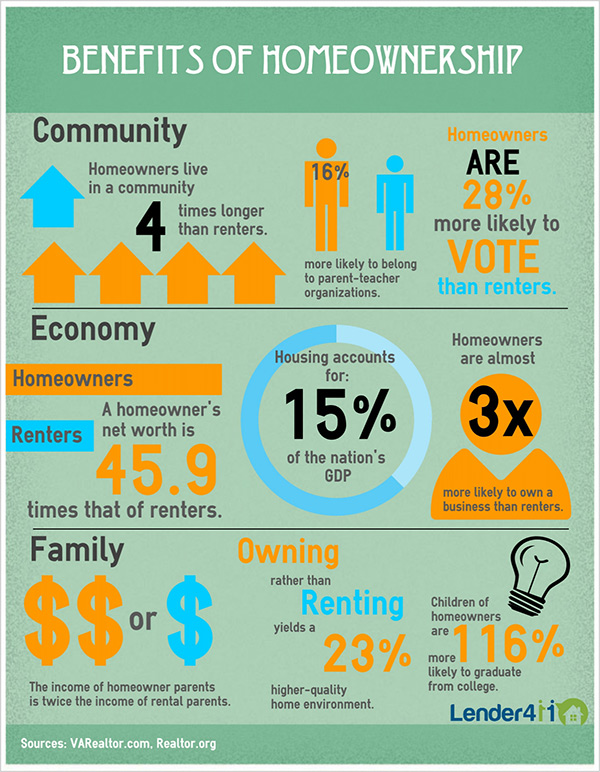

Infographic: Benefits of Homeownership

Looking to buy a home? There are many benefits you should know about. The statistics illustrate the implications of increased wealth, long term stability, quality environment and your children's future. .

Looking to buy a home? There are many benefits you should know about. The statistics illustrate the implications of increased wealth, long term stability, quality environment and your children's future. .

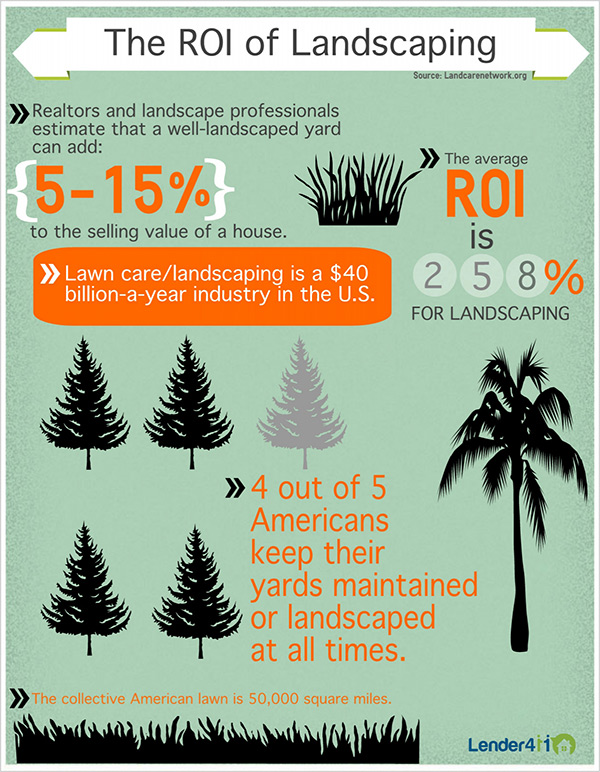

Infographic: The ROI of Landscaping

Lanscaping will make you money when you sell your home. Find out how to gain return on investment for home improvement in this infographic. You can add 5 - 15 % to the value of your home and retain a 258% return on your landscaping investment..

Lanscaping will make you money when you sell your home. Find out how to gain return on investment for home improvement in this infographic. You can add 5 - 15 % to the value of your home and retain a 258% return on your landscaping investment..

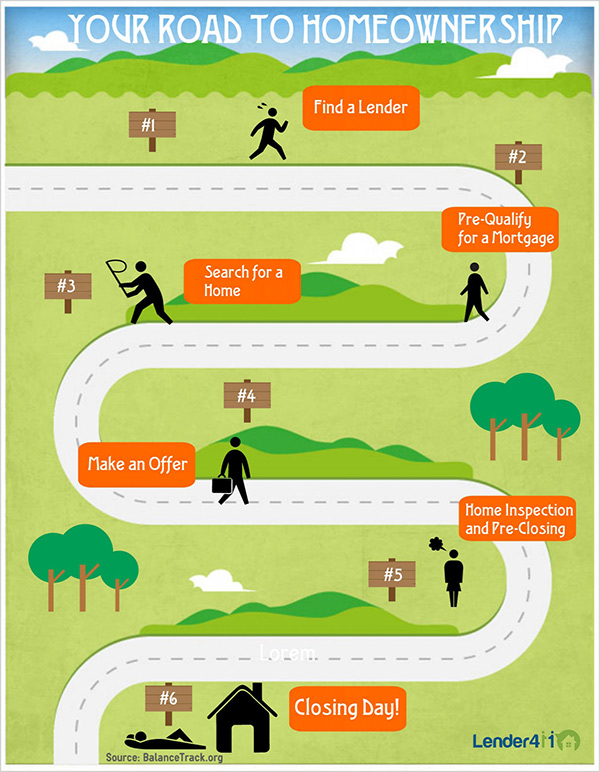

Infographic: Your Road to Homeownership

#1: Find a Lender.. Before you start the whole process of buying a home, you're going to need to find a reputable lender who will give you the home loan that will let you buy your home. Make sure to do your research and compare at least two or three lenders to see how they...

#1: Find a Lender.. Before you start the whole process of buying a home, you're going to need to find a reputable lender who will give you the home loan that will let you buy your home. Make sure to do your research and compare at least two or three lenders to see how they...

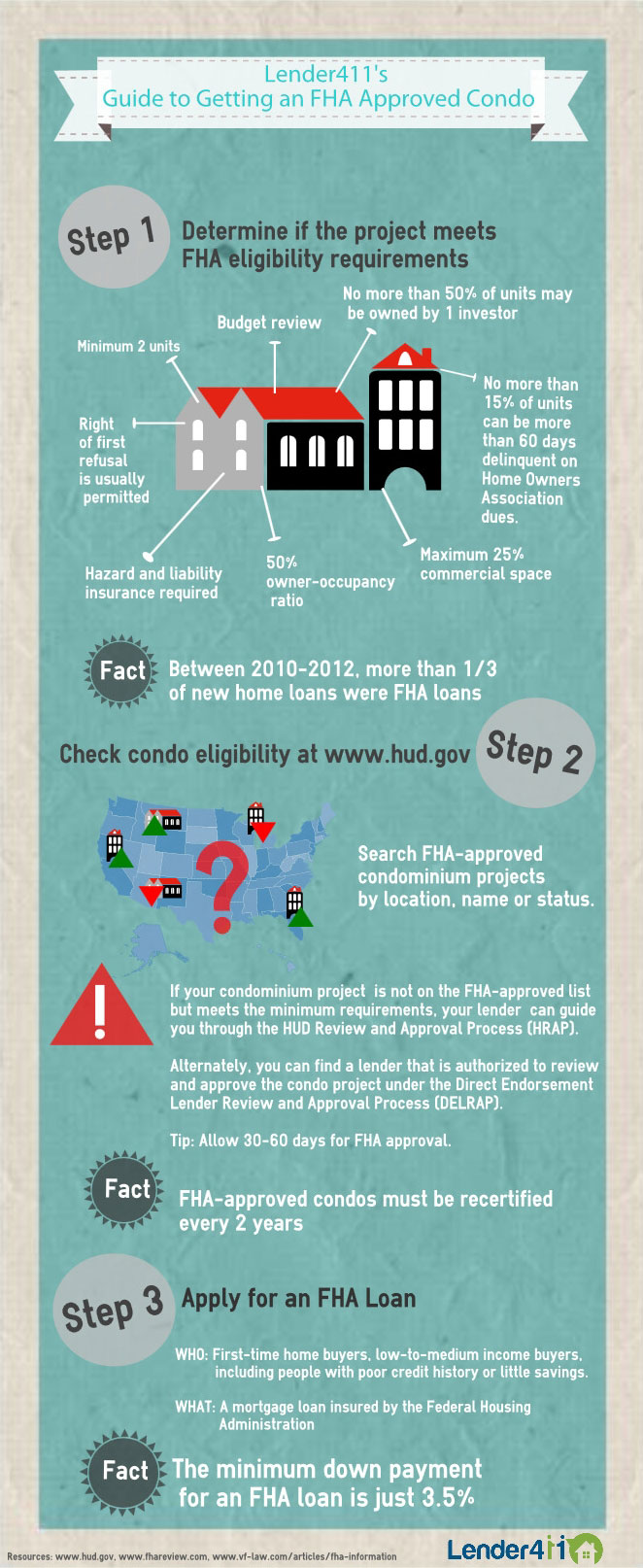

Infographic: Guide to Getting an FHA Approved Condo

This infographic illustrates a comprehensive list of requirements for a condominiums to receive FHA approval. After a pre-screen of the requirements, you must go online to hud.gov to ensure approval or you may contact a FHA certified lender to assess the property. .

This infographic illustrates a comprehensive list of requirements for a condominiums to receive FHA approval. After a pre-screen of the requirements, you must go online to hud.gov to ensure approval or you may contact a FHA certified lender to assess the property. .

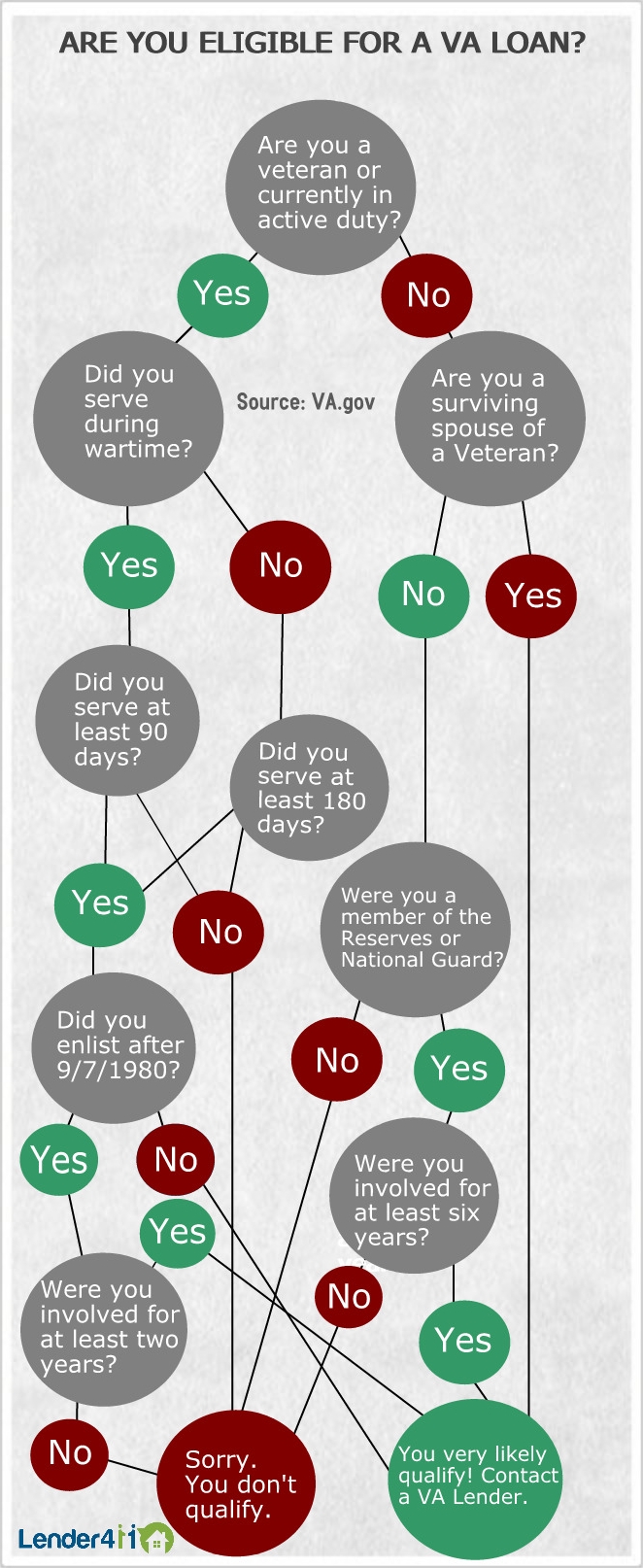

Infographic: VA Loan Eligibility

This infographic explains the VA loan eligibility for prospective borrowers. This is a flow chart to express the circumstances for veterans, active duty military and their spouses to qualify for a va home loan..

This infographic explains the VA loan eligibility for prospective borrowers. This is a flow chart to express the circumstances for veterans, active duty military and their spouses to qualify for a va home loan..

Infographic: Don't Wait To Buy

This infographic illustrates the affect mortgage interest rates have on monthly mortgage payments. The example demonstrates a 30-year fixed-rate mortgage at $250,000 and the subsequent effect an increase in interest rates will have on monthly payments..

This infographic illustrates the affect mortgage interest rates have on monthly mortgage payments. The example demonstrates a 30-year fixed-rate mortgage at $250,000 and the subsequent effect an increase in interest rates will have on monthly payments..

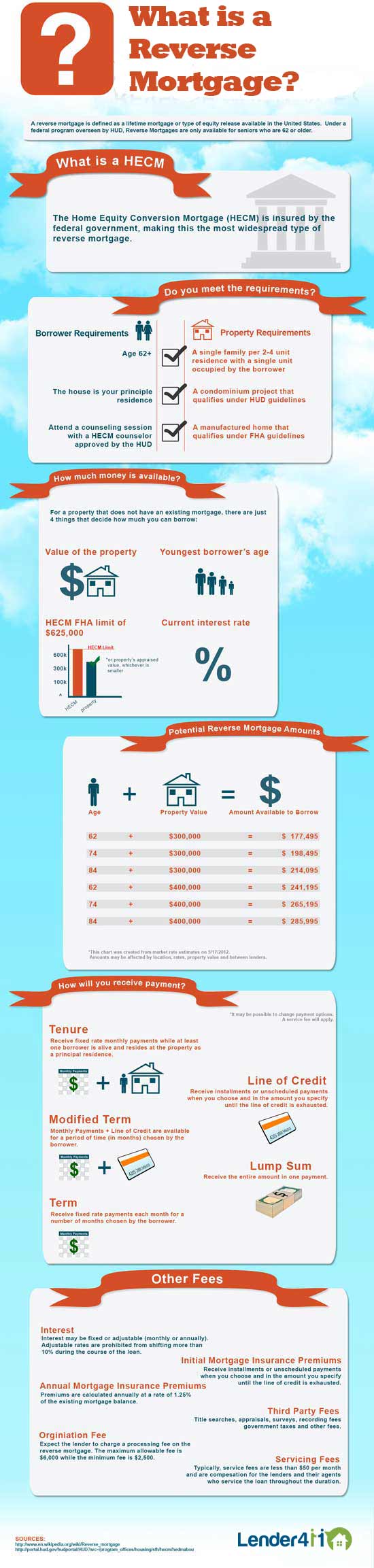

Lender411 Infographic: What is a Reverse Mortgage?

This infographic illustrates a reverse mortgage for seniors and the circumstancial requirements associated. It also details the fees, methods of payment and potential amount to be received..

This infographic illustrates a reverse mortgage for seniors and the circumstancial requirements associated. It also details the fees, methods of payment and potential amount to be received..

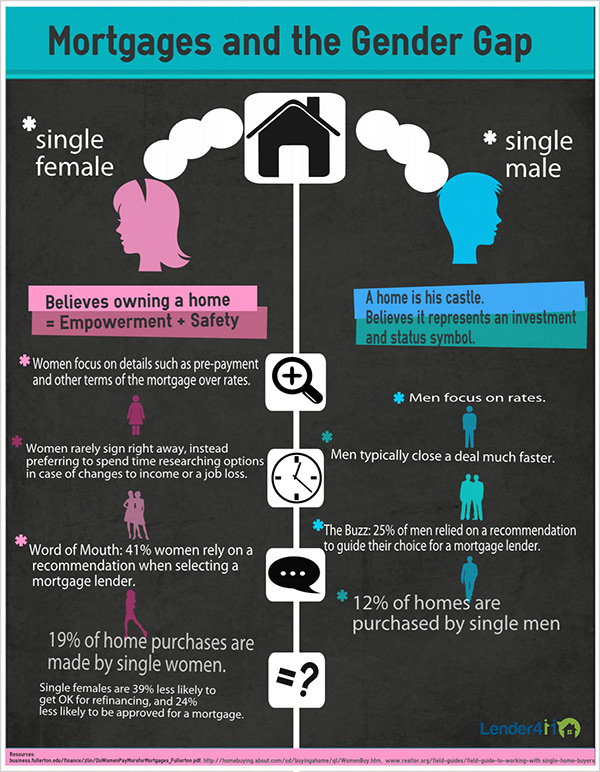

Infographic: Mortgages and the Gender Gap

This infographic examines the differences in mortgage and home buying practices between men and women. Women and men not only buy for different reasons, but they focus on different issues during the mortgage loan process. Check out this infographic to find out the stats..

This infographic examines the differences in mortgage and home buying practices between men and women. Women and men not only buy for different reasons, but they focus on different issues during the mortgage loan process. Check out this infographic to find out the stats..

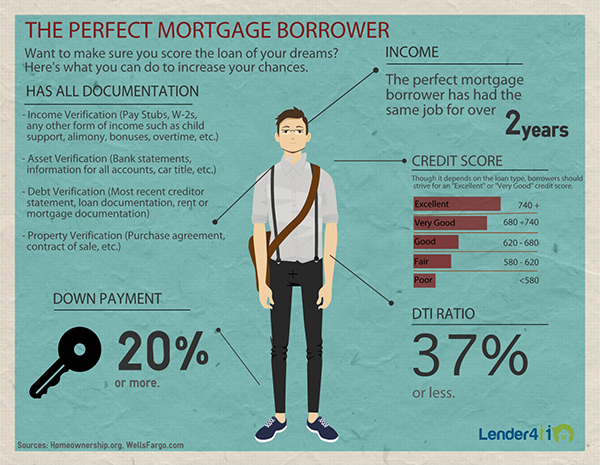

Infographic: The Perfect Mortgage Borrower

This infographic details the qualifications of the perfect mortgage borrower. To increase your chances of locking in your ideal mortgage loan, ensure you meet the following requirements. You will need to have had the same job for 2 years, a down payment of 20%, a DTI Ratio of 37%...

This infographic details the qualifications of the perfect mortgage borrower. To increase your chances of locking in your ideal mortgage loan, ensure you meet the following requirements. You will need to have had the same job for 2 years, a down payment of 20%, a DTI Ratio of 37%...

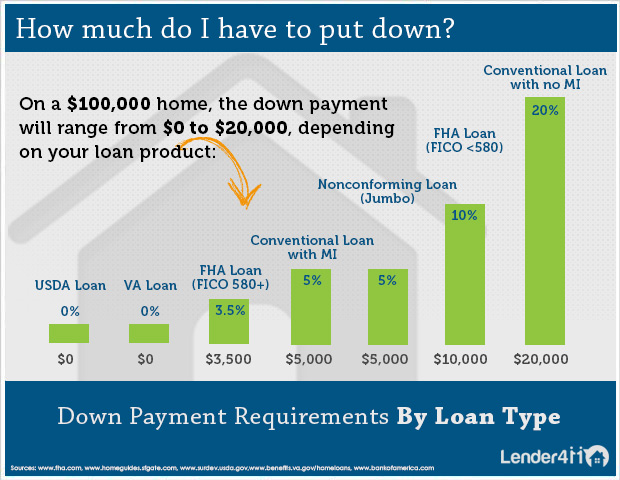

Infographic: Down Payment Requirements

How much do I have to put down? This infographic will provide detail on the down payment requirements by loan type. USDA and VA loans require no down payment, while FHA loans require 3.5% down. The remaining loan types the standard 5% minimum down payment requirement..

How much do I have to put down? This infographic will provide detail on the down payment requirements by loan type. USDA and VA loans require no down payment, while FHA loans require 3.5% down. The remaining loan types the standard 5% minimum down payment requirement..

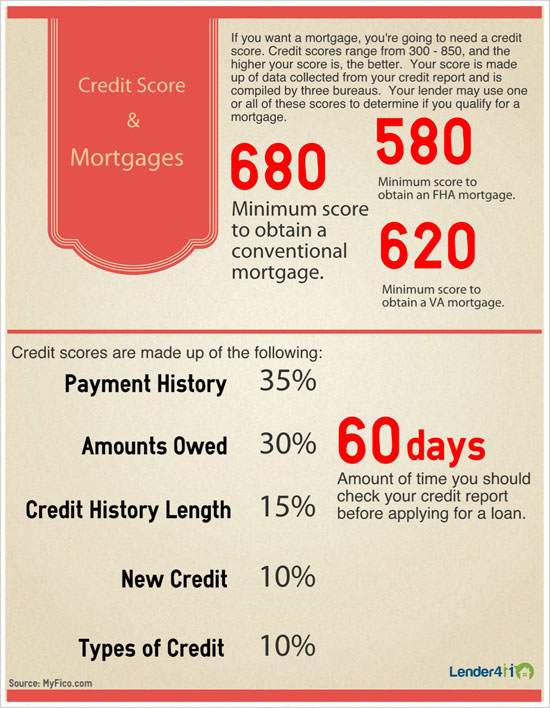

Infographic: Credit Score and Mortgages

This infographic illustrates credit scores and their affect on obtaining your preferred mortgage loan. The credit score is divided in to payment history, amount owed, credit history, new credit and the types of credit. Before applying for a loan, be sure to check your credit...

This infographic illustrates credit scores and their affect on obtaining your preferred mortgage loan. The credit score is divided in to payment history, amount owed, credit history, new credit and the types of credit. Before applying for a loan, be sure to check your credit...

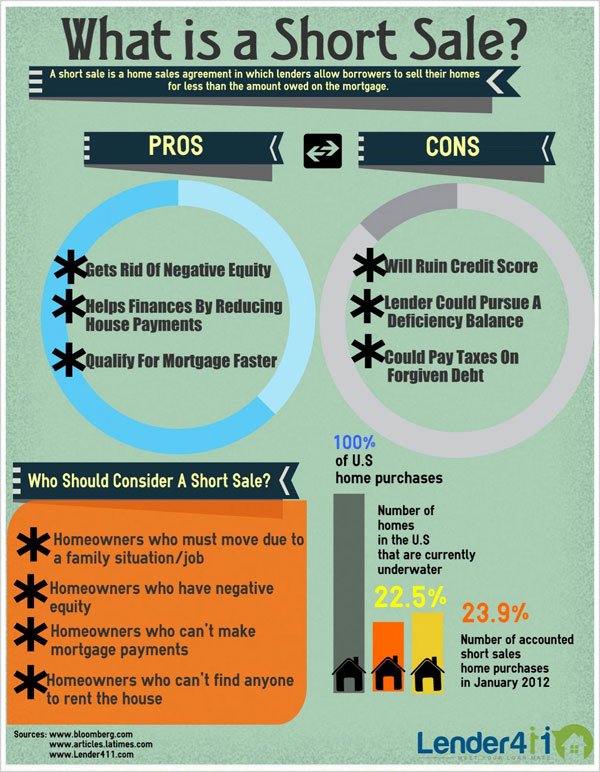

Infographic: What is a Short Sale?

This infographic will tell you everything you need to know and more about the short sale process. For more information about short sales, head over to Lender411's Short Sale page..

This infographic will tell you everything you need to know and more about the short sale process. For more information about short sales, head over to Lender411's Short Sale page..

Infographic: Government Shutdowns Timeline

The current bickering on Capitol Hill is not the first to result in a shutdown, and the process has a lengthy legacy rooted deep in the framing of the Constitution..

The current bickering on Capitol Hill is not the first to result in a shutdown, and the process has a lengthy legacy rooted deep in the framing of the Constitution..

Ask our community a question.

Get an answer

Related Articles

Featured Lenders

Lisa Stepp

RBS Citizens

Clifton Park, NY

Kat Whitman

Whitman Met, Inc.

Sacramento, CA

Cameron Burke

Vision One Mortgage

Huntington Beach, CA