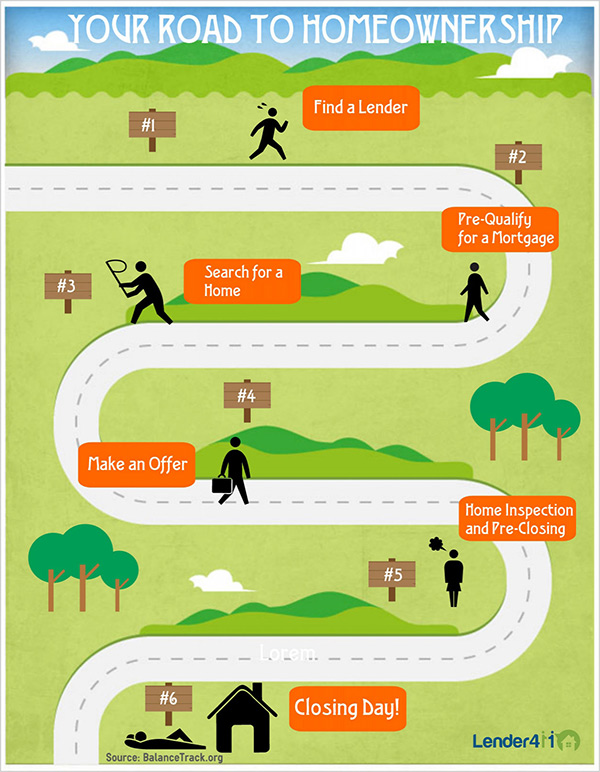

Infographic: Your Road to Homeownership

Updated on 9/25/2013

Embed Code:

#1: Find a Lender.

Before you start the whole process of buying a home, you're going to need to find a reputable lender who will give you the home loan that will let you buy your home. Make sure to do your research and compare at least two or three lenders to see how they differ. Ways in which lenders could differ include: rates, closing costs, loan limits, and closing time.

#2: Pre-Qualify for a Mortgage.

Once you have established a relationship with a reputable lender whom you trust, see if you can pre-qualify for a home loan. Pre-qualifying doesn't require any formal commitment, but gives you and your lender an estimate of how much you might be able to qualify for with a home loan. This will help you search for homes within your price range, and will expedite the process of formally obtaining a loan if you find a home you like in your search.

#3: Search for a Home.

After you have pre-qualified for a loan, you can start the fun part - searching for a home! You can either do this by searching alone or working with a realtor. If you do choose to work with a realtor, make sure to ask for referrals as well as comparison shop before finally deciding on a realtor. When looking for a home, remember to write down the positive and negative aspects after each showing - this will make it easier to narrow the choosing down.

#4: Make an Offer.

If you found a home you loved, it's time to make an offer! Your offer will be made up of three parts: the price you are willing to pay, the date you wish to close, and how long your particular offer stands. In your offer, feel free to include contingencies and concessions, such as having the seller paying your closing costs or leaving behind the washer/dryer. The seller can either accept, reject, or counter your offer.

#5: Home Inspection/Pre-Closing

Congratulations, the seller accepted! As soon as this happens, you should arrange for a home inspection to make sure . This also begins the pre-closing period - you might get requests for additional paperwork from your lender during this time.

#6: Closing Day!

Today's the day! Closing day just means that this is the day that the house's title is transferred over to you. You will be signing a lot of documents today, so make sure to take your time and read through everything so you understand all the terms and contracts. These documents will include your mortgage note, mortgage deed, Hud-1 Settlement Statement, and Truth in Lending Statement. There is a light at the end of the tunnel, however...at the end of all the document signing, you will obtain the keys to your new home!

Didn't find the answer you wanted? Ask one of your own.

-

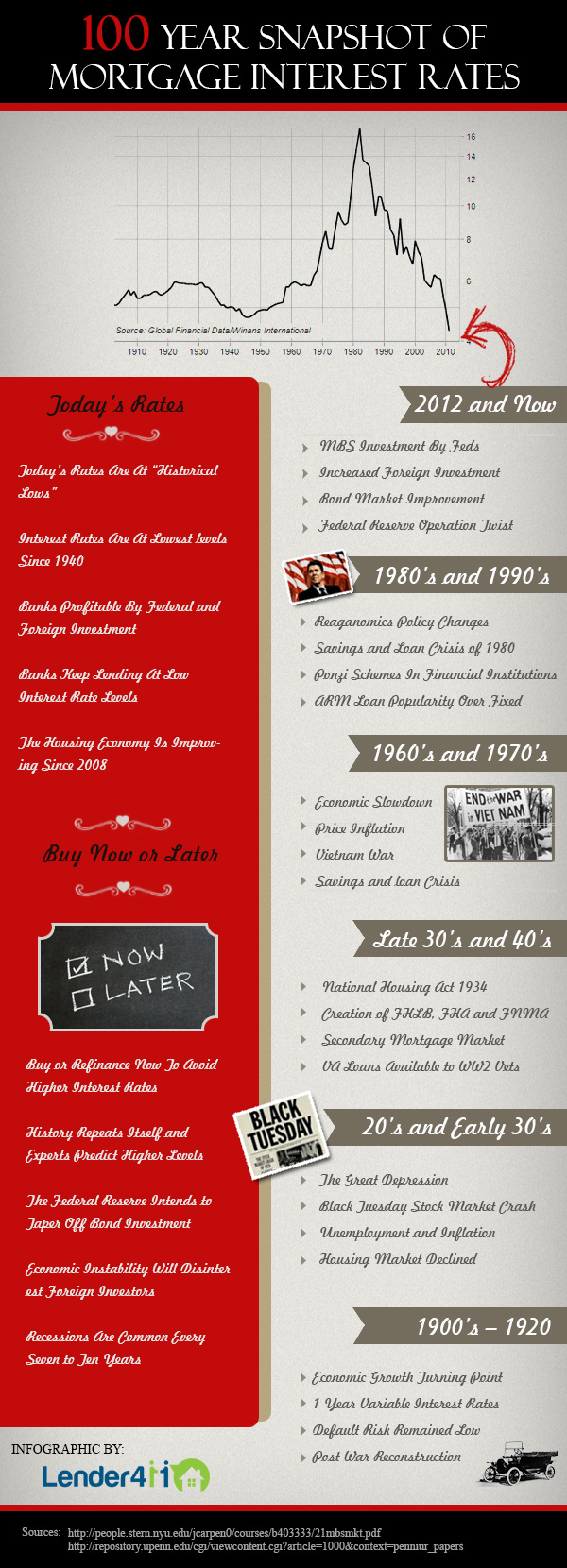

Infographic: 100 Year Snapshot of Mortgage Interest Rates

View More

Infographic: 100 Year Snapshot of Mortgage Interest Rates

View More

-

Infographic: Fast Ways to Boost Your Credit Score

View More

Infographic: Fast Ways to Boost Your Credit Score

View More

-

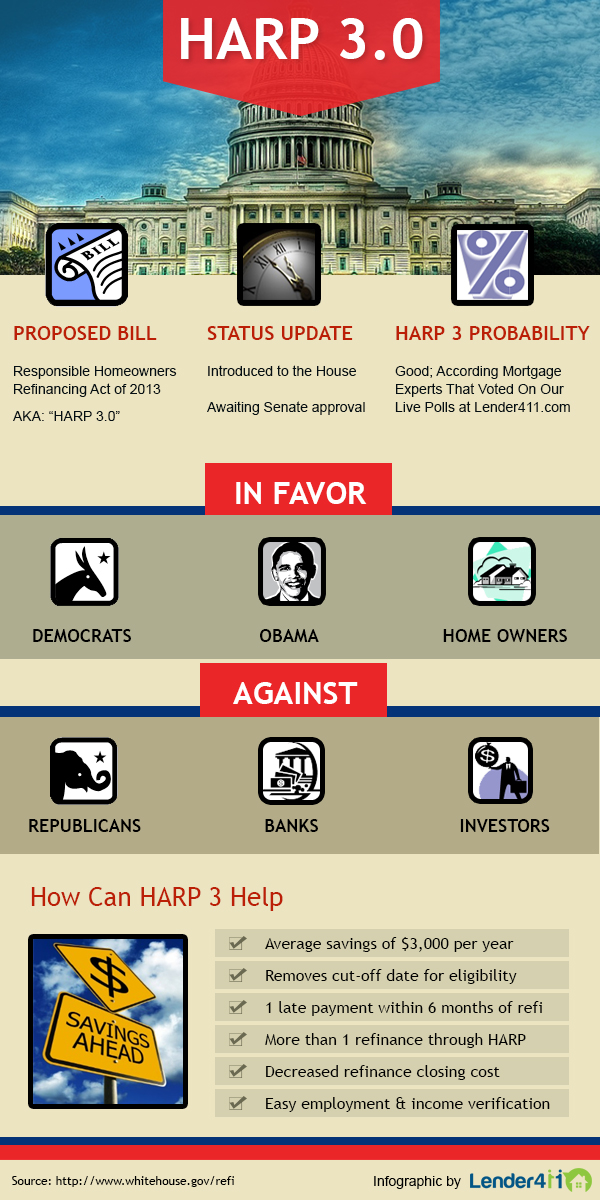

Infographic: HARP 3.0

View More

Infographic: HARP 3.0

View More

-

Infographic: 401K For Down Payment

View More

Infographic: 401K For Down Payment

View More

-

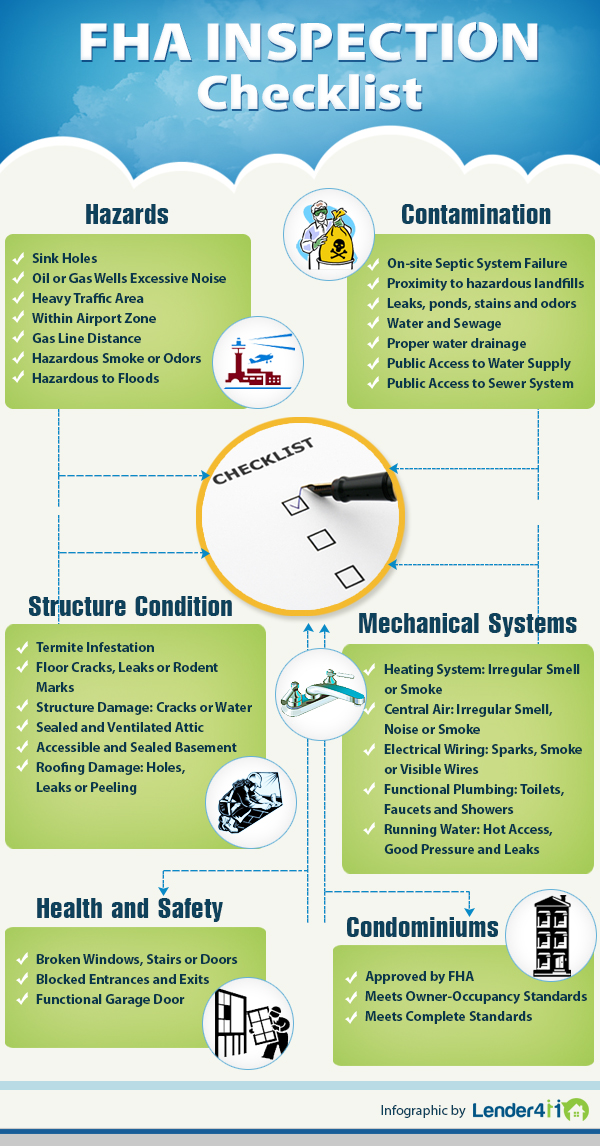

Infographic: FHA Inspection Checklist

View More

Infographic: FHA Inspection Checklist

View More

-

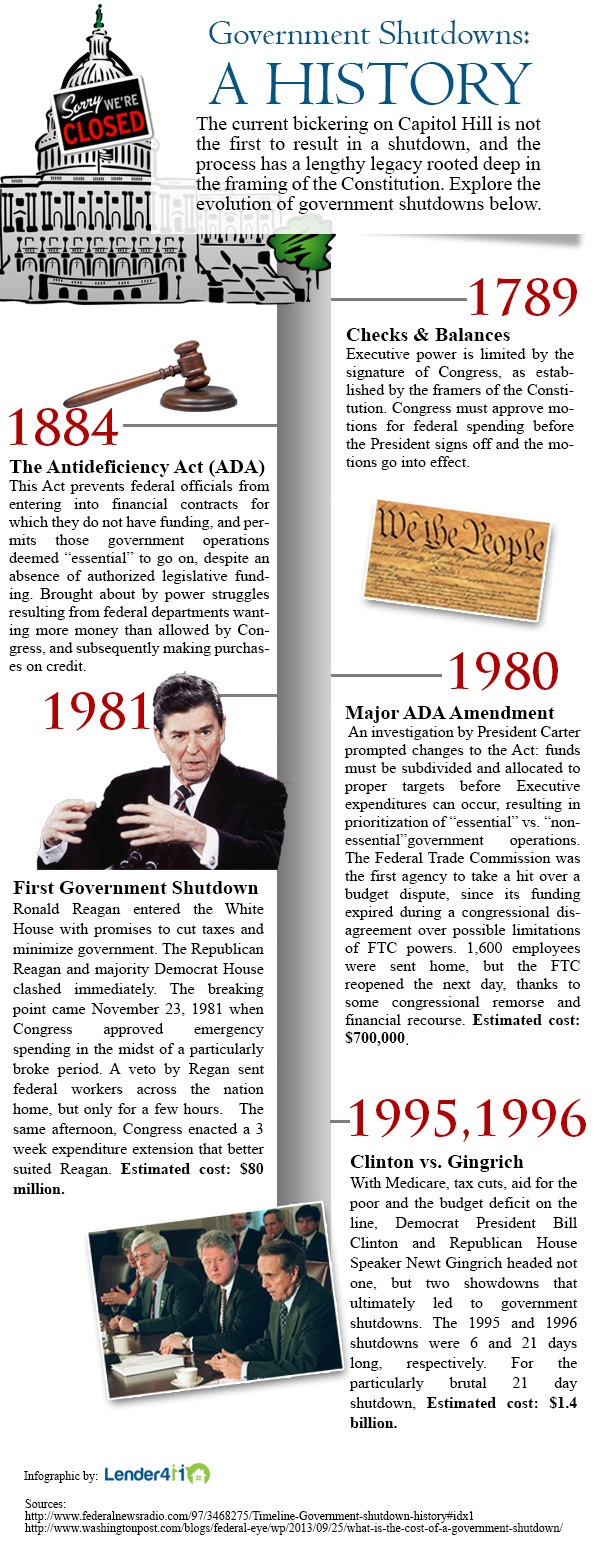

Infographic: Government Shutdowns Timeline

View More

Infographic: Government Shutdowns Timeline

View More

-

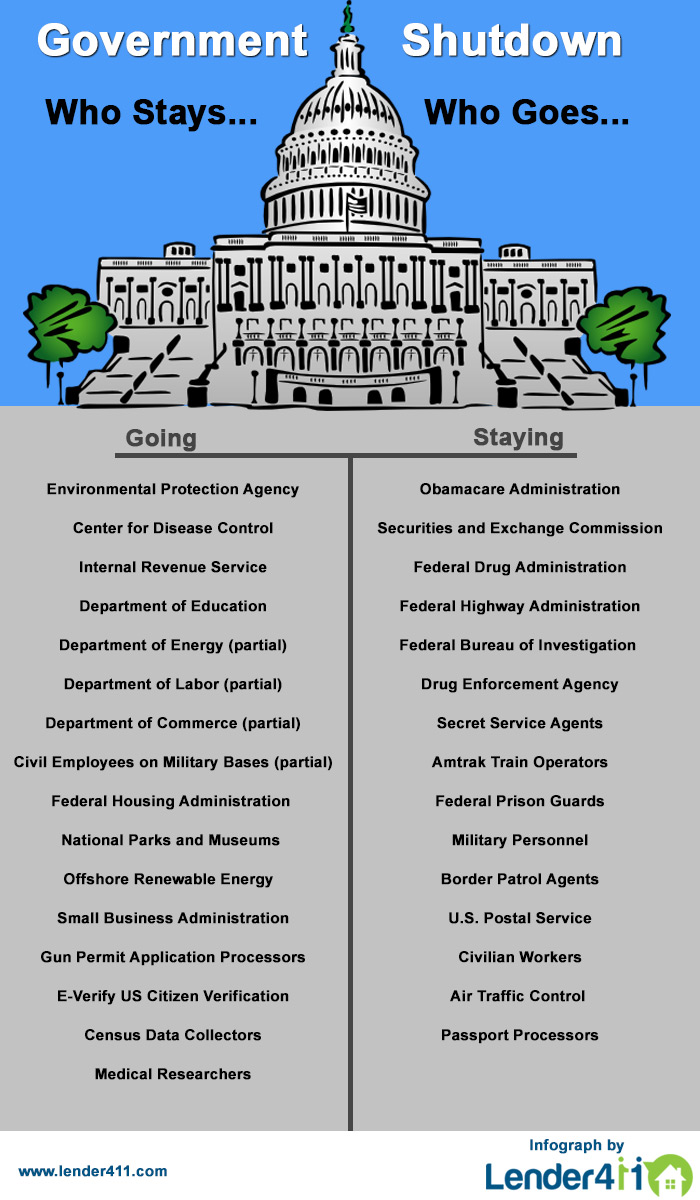

Infographic: Government Shutdown - Who Stays and Who Goes?

View More

Infographic: Government Shutdown - Who Stays and Who Goes?

View More

-

Infographic: Should I Refinance My Mortgage

View More

Infographic: Should I Refinance My Mortgage

View More

-

Infographic: How Would Federal Tapering Affect me?

View More

Infographic: How Would Federal Tapering Affect me?

View More

-

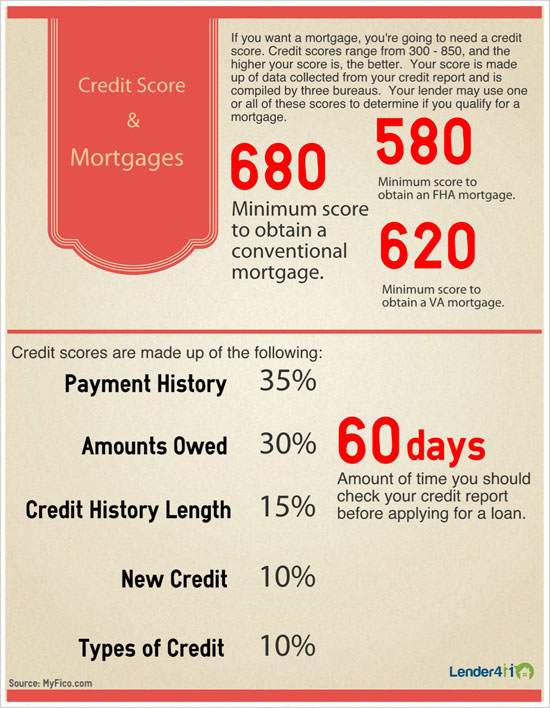

Infographic: Credit Score and Mortgages

View More

Infographic: Credit Score and Mortgages

View More

-

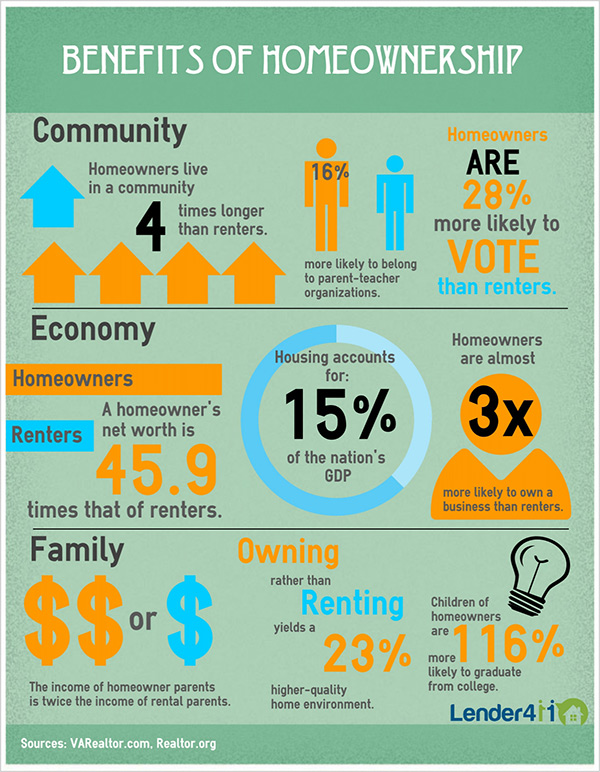

Infographic: Benefits of Homeownership

View More

Infographic: Benefits of Homeownership

View More

-

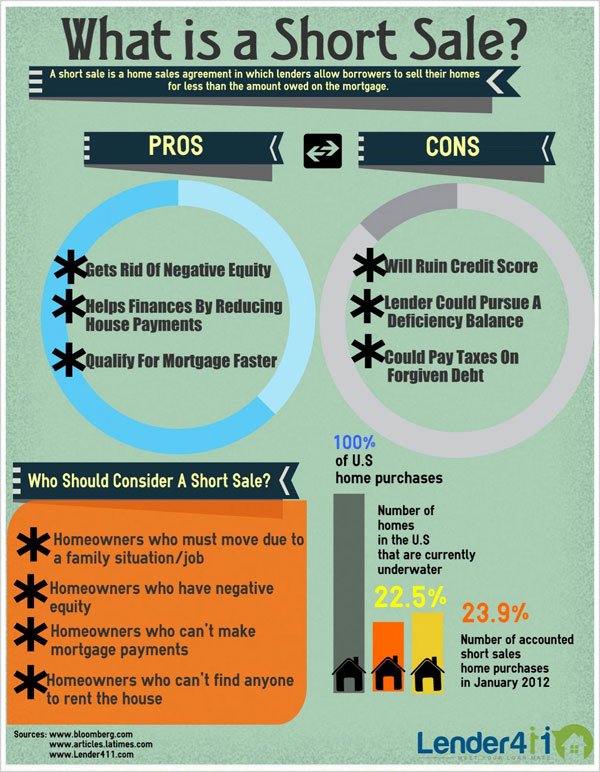

Infographic: What is a Short Sale?

View More

Infographic: What is a Short Sale?

View More

-

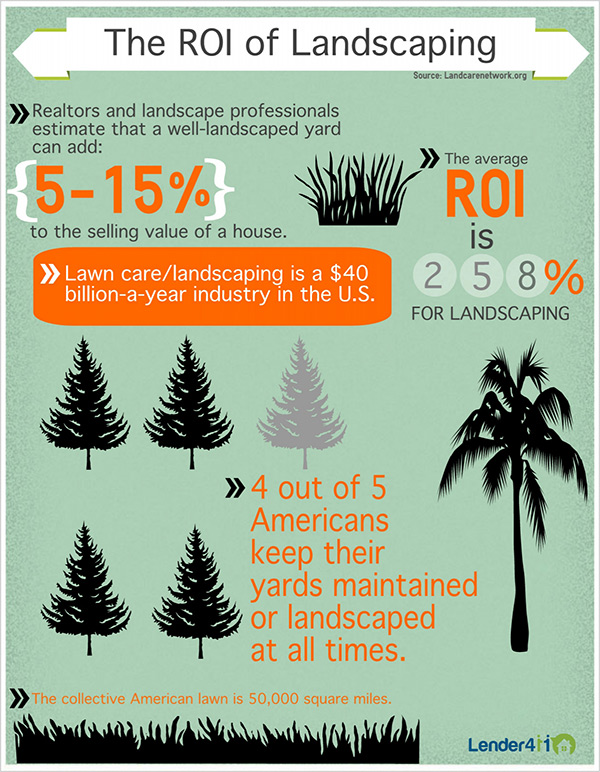

Infographic: The ROI of Landscaping

View More

Infographic: The ROI of Landscaping

View More

-

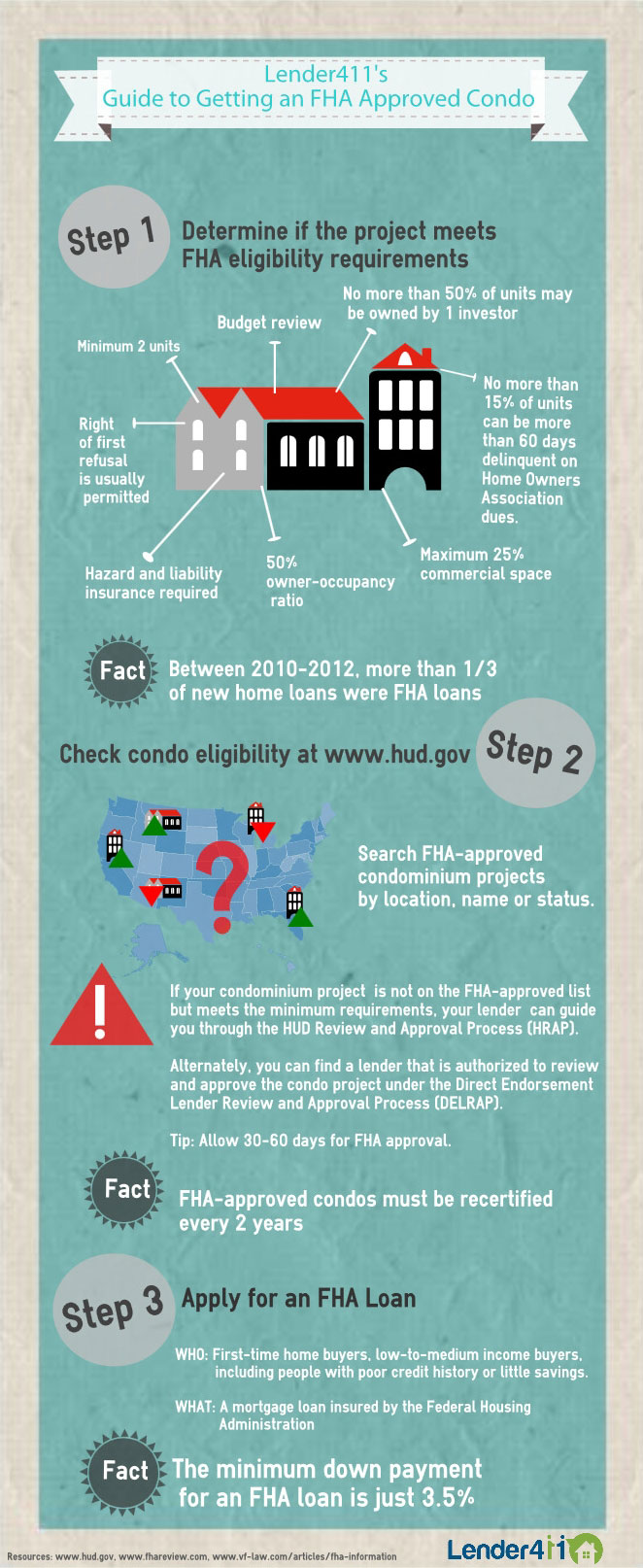

Infographic: Guide to Getting an FHA Approved Condo

View More

Infographic: Guide to Getting an FHA Approved Condo

View More

-

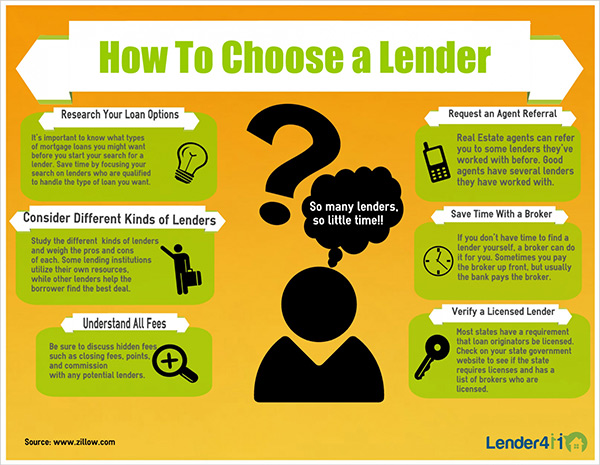

Infographic: How to Choose a Lender

View More

Infographic: How to Choose a Lender

View More

Related Articles

Ask our community a question.

Searching Today's Rates...

Featured Lenders

Lisa Stepp

RBS Citizens

Clifton Park, NY

Cameron Burke

Vision One Mortgage

Huntington Beach, CA

Kat Whitman

Whitman Met, Inc.

Sacramento, CA