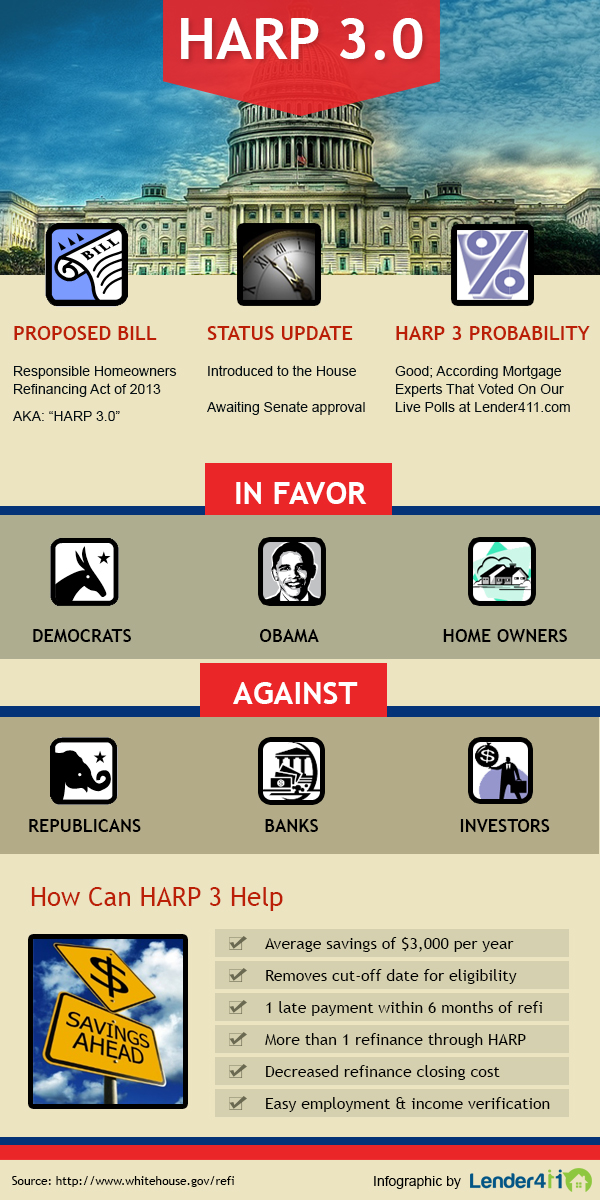

Infographic: HARP 3.0

Updated on 10/11/2013

Want to lower your house payment? HARP refinance is your best option. This government assisted refinance option allows you to modify your current loan to lower interest rates. HARP 3.0 is a revision to the current program, which includes a decrease in restrictions for qualification and implies the possibilty of saving $3,000 per year. Check out our HARP 3.0 Update for more information on HARP 3 and its current status.

Embed Code:

Didn't find the answer you wanted? Ask one of your own.

-

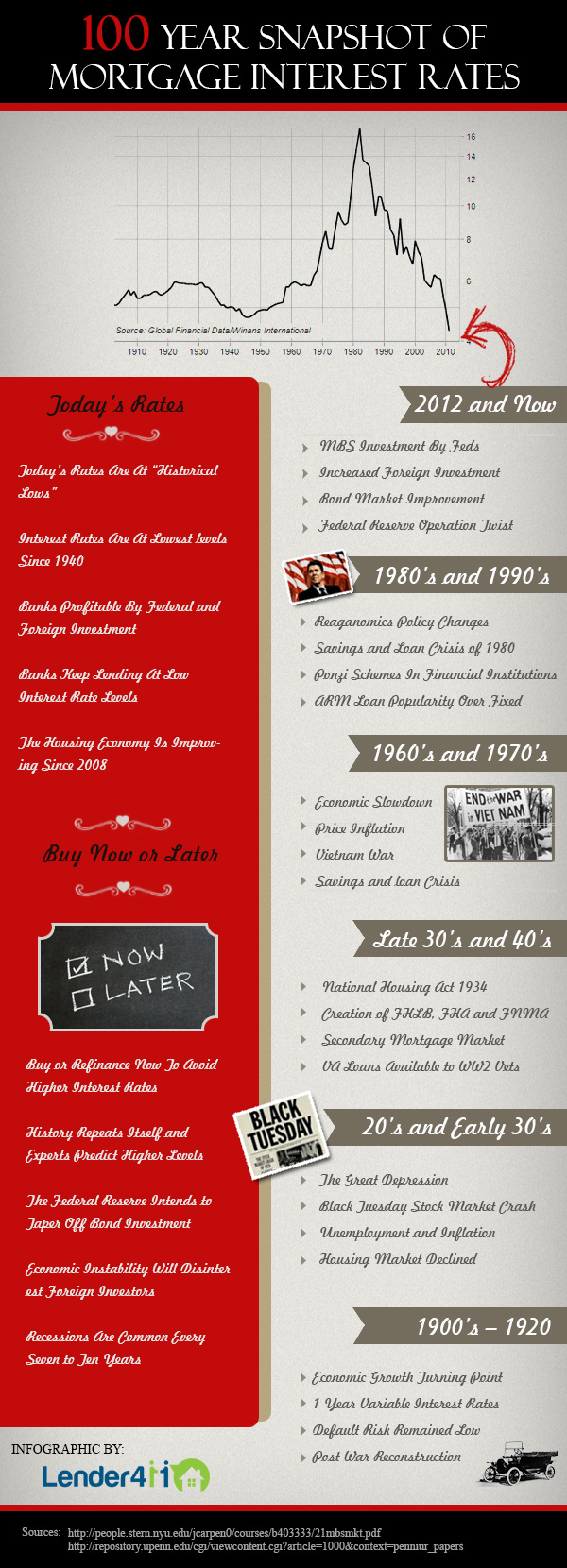

Infographic: 100 Year Snapshot of Mortgage Interest Rates

View More

Infographic: 100 Year Snapshot of Mortgage Interest Rates

View More

-

Infographic: Fast Ways to Boost Your Credit Score

View More

Infographic: Fast Ways to Boost Your Credit Score

View More

-

Infographic: 401K For Down Payment

View More

Infographic: 401K For Down Payment

View More

-

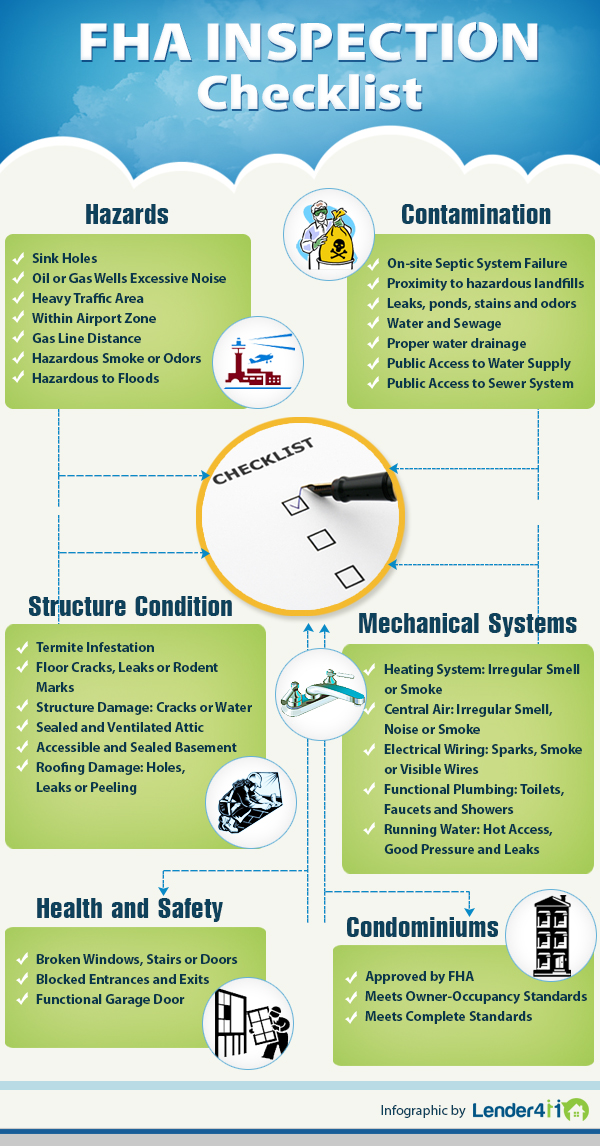

Infographic: FHA Inspection Checklist

View More

Infographic: FHA Inspection Checklist

View More

-

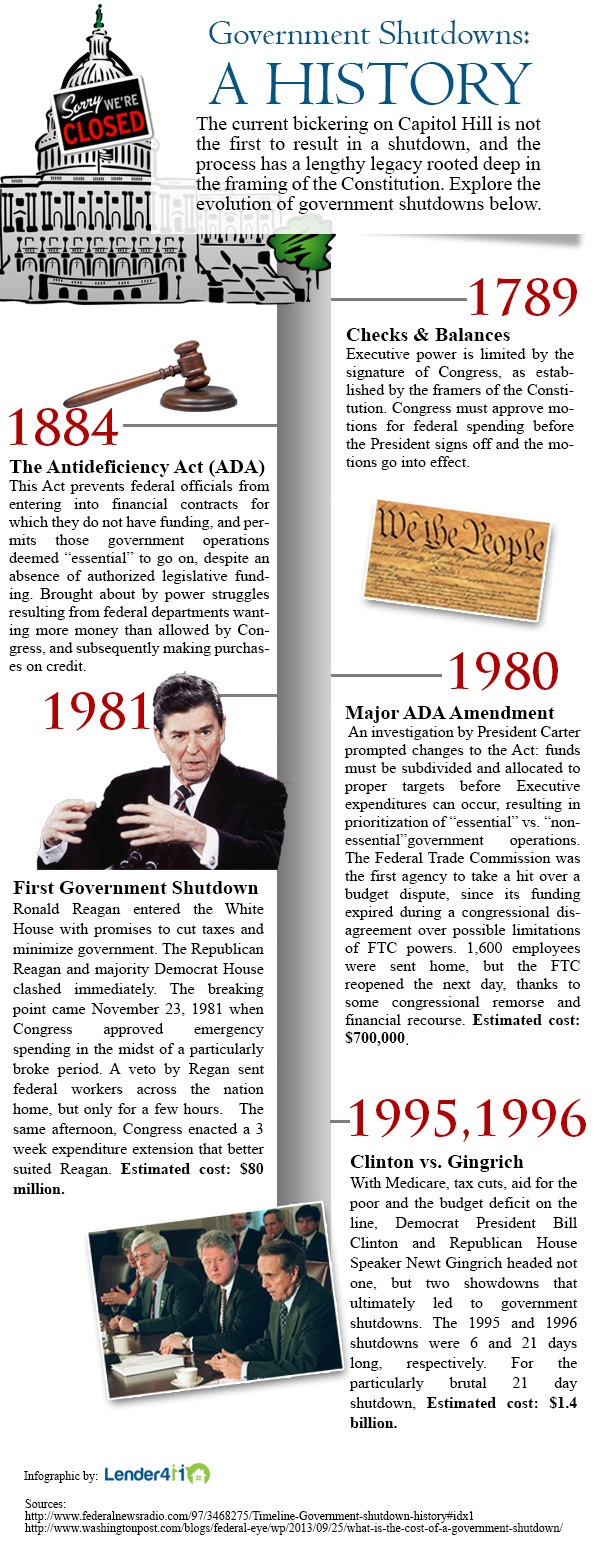

Infographic: Government Shutdowns Timeline

View More

Infographic: Government Shutdowns Timeline

View More

-

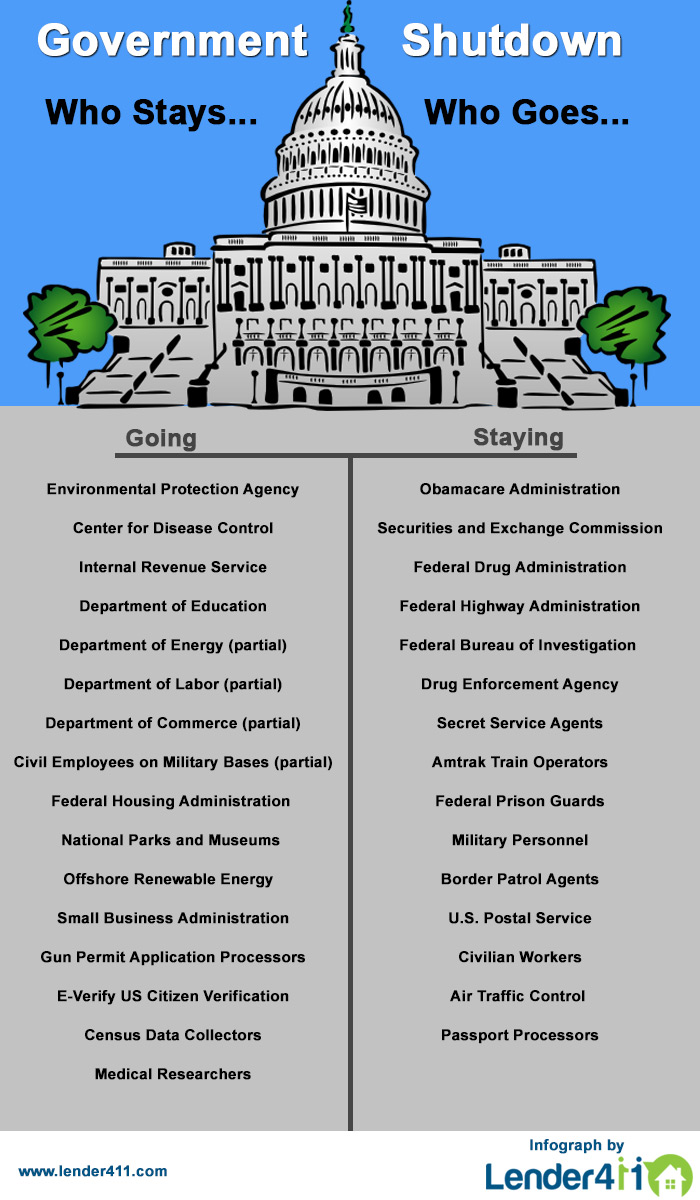

Infographic: Government Shutdown - Who Stays and Who Goes?

View More

Infographic: Government Shutdown - Who Stays and Who Goes?

View More

-

Infographic: Should I Refinance My Mortgage

View More

Infographic: Should I Refinance My Mortgage

View More

-

Infographic: How Would Federal Tapering Affect me?

View More

Infographic: How Would Federal Tapering Affect me?

View More

-

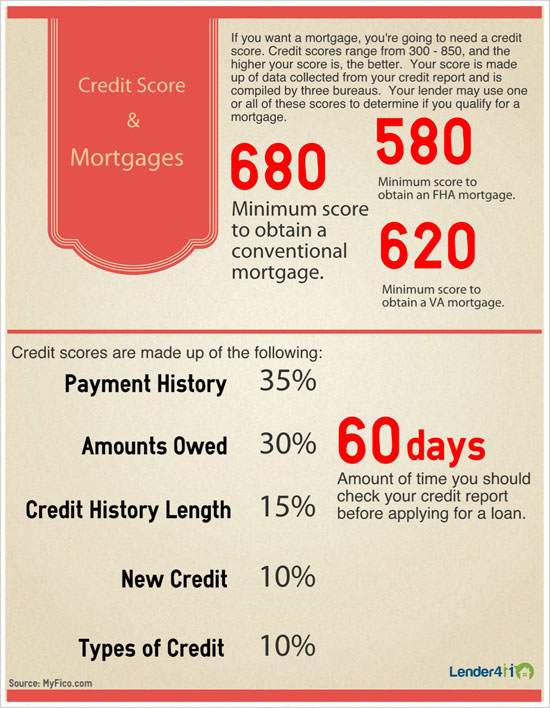

Infographic: Credit Score and Mortgages

View More

Infographic: Credit Score and Mortgages

View More

-

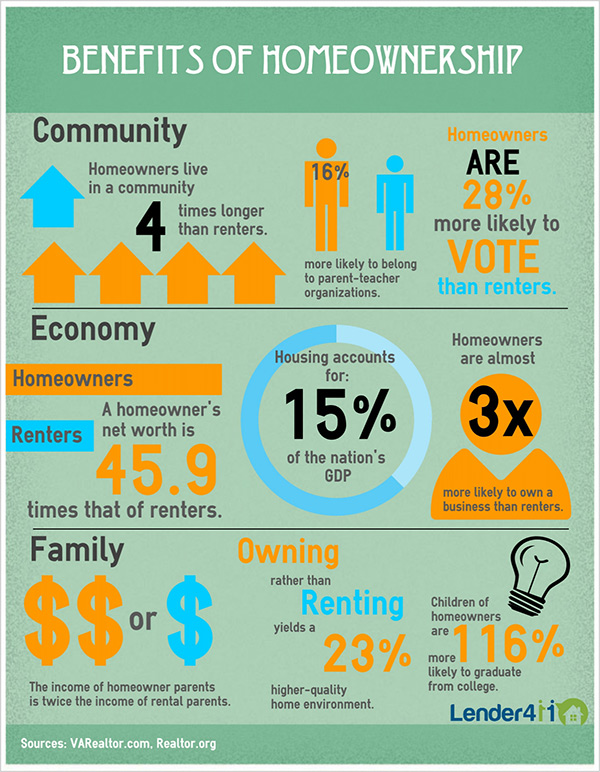

Infographic: Benefits of Homeownership

View More

Infographic: Benefits of Homeownership

View More

-

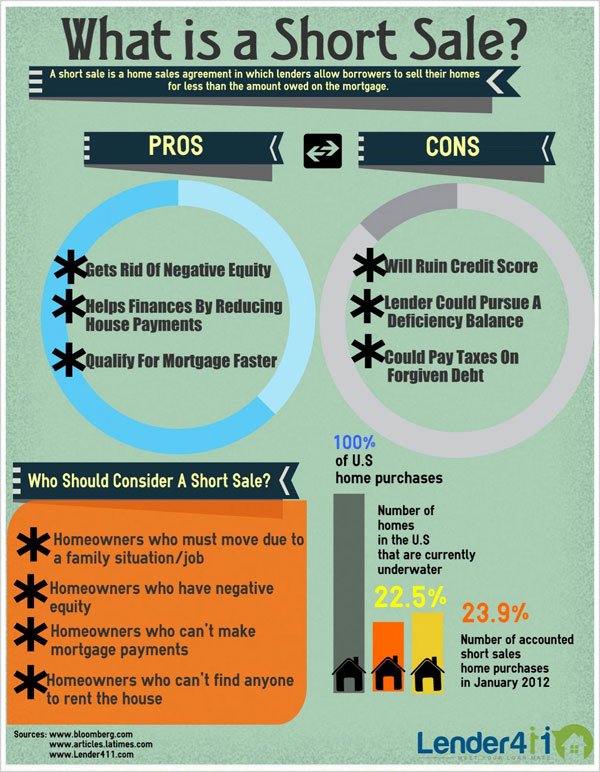

Infographic: What is a Short Sale?

View More

Infographic: What is a Short Sale?

View More

-

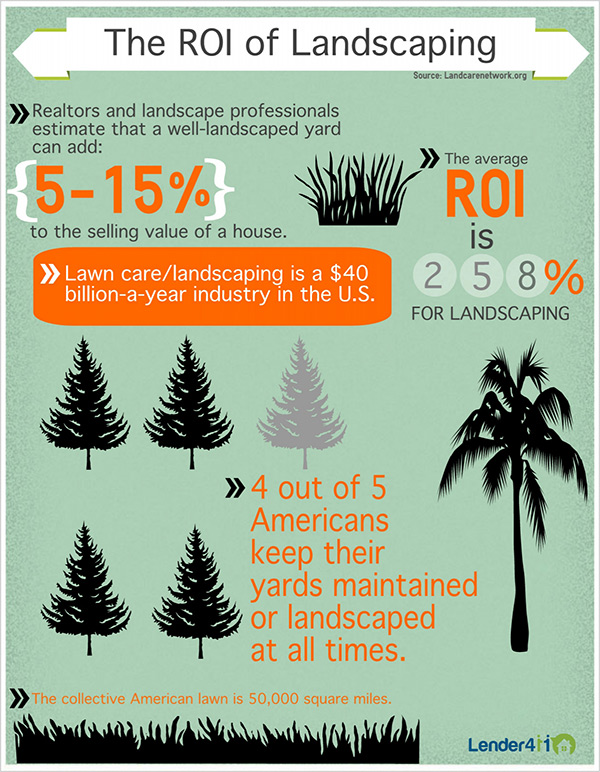

Infographic: The ROI of Landscaping

View More

Infographic: The ROI of Landscaping

View More

-

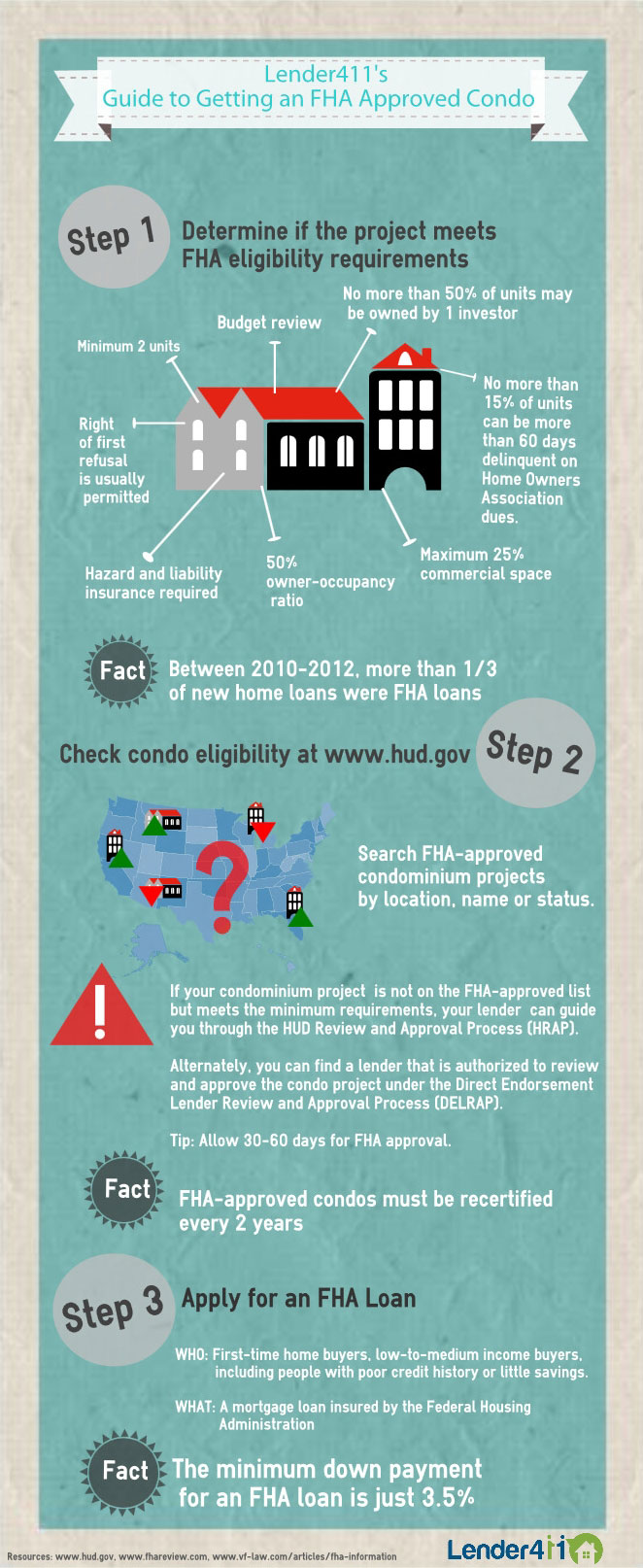

Infographic: Guide to Getting an FHA Approved Condo

View More

Infographic: Guide to Getting an FHA Approved Condo

View More

-

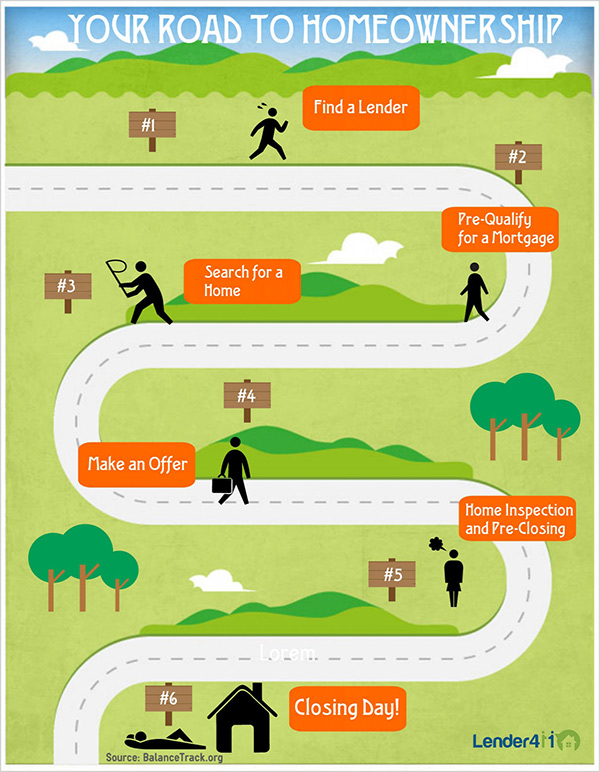

Infographic: Your Road to Homeownership

View More

Infographic: Your Road to Homeownership

View More

-

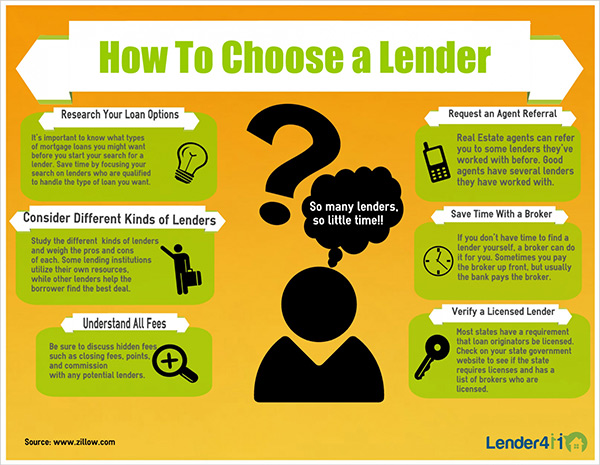

Infographic: How to Choose a Lender

View More

Infographic: How to Choose a Lender

View More

Related Articles

Ask our community a question.

Searching Today's Rates...

Featured Lenders

Cameron Burke

Vision One Mortgage

Huntington Beach, CA

Lisa Stepp

RBS Citizens

Clifton Park, NY

Kat Whitman

Whitman Met, Inc.

Sacramento, CA