Down Payment Articles

What is a Down Payment?

During mortgage transactions, lenders prefer to work with borrowers who invest a larger down payment. In the aftermath of the subprime mortgage market collapse, the burst of the U.S. housing market bubble, and the resulting economic downturn, the days of the no-down...

During mortgage transactions, lenders prefer to work with borrowers who invest a larger down payment. In the aftermath of the subprime mortgage market collapse, the burst of the U.S. housing market bubble, and the resulting economic downturn, the days of the no-down...

Advantages of a Larger Down Payment

Many borrowers attempt to secure loans with minimal down payment requirements, but paying more money up front can have numerous advantages.. Pay Less Interest. Putting forth a large sum for a down payment will save borrowers thousands of dollars of accrued interest over the...

Many borrowers attempt to secure loans with minimal down payment requirements, but paying more money up front can have numerous advantages.. Pay Less Interest. Putting forth a large sum for a down payment will save borrowers thousands of dollars of accrued interest over the...

How Much Down Payment is Necessary to Obtain Home Financing?

How much money do you need for a down payment on a home?. Most people will say between 10% to 20% down. However, there are programs which allow you to finance 100% of the home’s value, and other programs which allow you to finance with as little as 3% down.. There is also...

How much money do you need for a down payment on a home?. Most people will say between 10% to 20% down. However, there are programs which allow you to finance 100% of the home’s value, and other programs which allow you to finance with as little as 3% down.. There is also...

5 Ways to Get the Money for Your Down Payment

You likely don’t have access to established equity to fund the down payment on your new home if you're a first-time home buyer. However, there are ways around this obstacle.. 1. Adjust your budget and save. If you don’t have any money...

You likely don’t have access to established equity to fund the down payment on your new home if you're a first-time home buyer. However, there are ways around this obstacle.. 1. Adjust your budget and save. If you don’t have any money...

Down Payment Assistance Programs in Northeast Ohio

One of the biggest challenges first time home buyers face is coming up with the required down payment. According to a 2013 survey by the National Association of Realtors (NAR), twelve percent of buyers cite down payment as their main difficulty in purchasing a house.. In 2011,...

One of the biggest challenges first time home buyers face is coming up with the required down payment. According to a 2013 survey by the National Association of Realtors (NAR), twelve percent of buyers cite down payment as their main difficulty in purchasing a house.. In 2011,...

First Time Home Buyer Down Payment

For many first time home buyers, down payments can be a significant obstacle to obtaining a mortgage loan, as most home loans require sizeable sums up-front. This article will let you know what options are available to every type of first-time home buyer.. Down Payment...

For many first time home buyers, down payments can be a significant obstacle to obtaining a mortgage loan, as most home loans require sizeable sums up-front. This article will let you know what options are available to every type of first-time home buyer.. Down Payment...

Low and No Down Payment Mortgage Options

Whether you're a first time homebuyer or simply trying to keep your costs low, you may want to find a mortgage that has a low or no down payment option. There are some very specific options you could qualify for, depending on your unique situation and your financials. Here are...

Whether you're a first time homebuyer or simply trying to keep your costs low, you may want to find a mortgage that has a low or no down payment option. There are some very specific options you could qualify for, depending on your unique situation and your financials. Here are...

Down Payment Assistance Programs in Northeast Ohio

One of the biggest challenges first time home buyers face is coming up with the required down payment. According to a 2013 survey by the National Association of Realtors (NAR), twelve percent of buyers cite down payment as their main difficulty in purchasing a house.. In 2011,...

One of the biggest challenges first time home buyers face is coming up with the required down payment. According to a 2013 survey by the National Association of Realtors (NAR), twelve percent of buyers cite down payment as their main difficulty in purchasing a house.. In 2011,...

Infographic: 401K For Down Payment

Saving for a down payment on your first home? Save yourself the trouble and borrow from yourself. Your 401K is a great source of immediate cash for your down payment. Learn about it with this infographic..

Saving for a down payment on your first home? Save yourself the trouble and borrow from yourself. Your 401K is a great source of immediate cash for your down payment. Learn about it with this infographic..

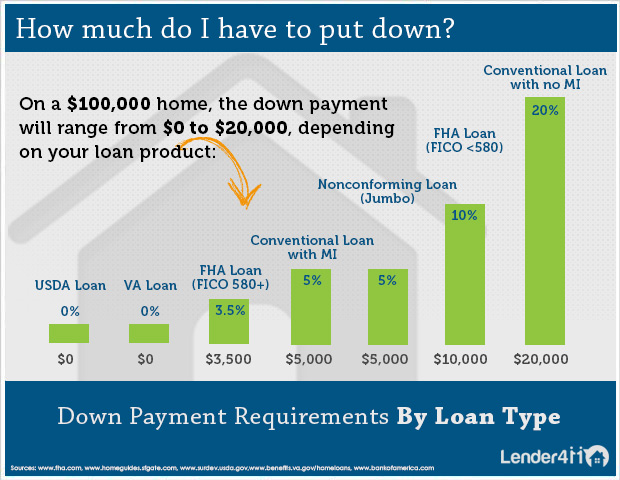

Infographic: Down Payment Requirements

How much do I have to put down? This infographic will provide detail on the down payment requirements by loan type. USDA and VA loans require no down payment, while FHA loans require 3.5% down. The remaining loan types the standard 5% minimum down payment requirement..

How much do I have to put down? This infographic will provide detail on the down payment requirements by loan type. USDA and VA loans require no down payment, while FHA loans require 3.5% down. The remaining loan types the standard 5% minimum down payment requirement..

Ask our community a question.

Get an answer

Related Articles

Featured Lenders

Lisa Stepp

RBS Citizens

Clifton Park, NY

Cameron Burke

Vision One Mortgage

Huntington Beach, CA

Kat Whitman

Whitman Met, Inc.

Sacramento, CA