Closing Costs Articles

Which Closing Costs Are Negotiable?

For home buyers getting a mortgage loan, closing costs are a significant expense, especially combined with the price of a down payment. . As such, borrowers must save up before a home purchase to cover these costs. However, with some sound advice and...

For home buyers getting a mortgage loan, closing costs are a significant expense, especially combined with the price of a down payment. . As such, borrowers must save up before a home purchase to cover these costs. However, with some sound advice and...

What Happens at a Mortgage Closing?

At a closing, ownership of the newly purchased home is transferred to you. It involves you, the seller, the real estate agent, representatives from the title or escrow firm, clerks, secretaries, attorneys and other staff. . It is possible to have an attorney act on your...

At a closing, ownership of the newly purchased home is transferred to you. It involves you, the seller, the real estate agent, representatives from the title or escrow firm, clerks, secretaries, attorneys and other staff. . It is possible to have an attorney act on your...

Calculating your Refinance Closing Costs

When refinancing, borrowers should calculate the costs of the refinance against the potential benefits. Typically, this requires comparing the gains of a lower interest rate or shorter term against the cost of securing a refinance loan. . However, evaluating the cost...

When refinancing, borrowers should calculate the costs of the refinance against the potential benefits. Typically, this requires comparing the gains of a lower interest rate or shorter term against the cost of securing a refinance loan. . However, evaluating the cost...

What Are Mortgage Points?

The term "point" refers to a lender fee. One point is equivalent to 1% of your mortgage loan. If mortgage points sound tricky, it’s because they can be. . It is best that you are prepared to ensure the lowest interest rate and prevent unexpected...

The term "point" refers to a lender fee. One point is equivalent to 1% of your mortgage loan. If mortgage points sound tricky, it’s because they can be. . It is best that you are prepared to ensure the lowest interest rate and prevent unexpected...

What Are Finance and Lender Charges?

Most people associate closing costs with the finance charges that are levied by lenders. The charges you pay will vary among lenders, so it's worth it to shop around for the best combination of mortgage terms and closing (or settlement) costs. . These are some charges...

Most people associate closing costs with the finance charges that are levied by lenders. The charges you pay will vary among lenders, so it's worth it to shop around for the best combination of mortgage terms and closing (or settlement) costs. . These are some charges...

6 Ways You Can Reduce Your Home Mortgage Costs

The closing costs of a home loan include appraisal fees, inspection fees, broker fees, title fees, administrative fees, and others. . Closing costs can account for a significant portion of the cost of the loan. When looking for the lowest mortgage rates, ask lenders what...

The closing costs of a home loan include appraisal fees, inspection fees, broker fees, title fees, administrative fees, and others. . Closing costs can account for a significant portion of the cost of the loan. When looking for the lowest mortgage rates, ask lenders what...

Buying Your First Home, The Survival Guide: Calculating Costs

Editor's Note: This article is the second in Lender411's Buying Your First Home, The Survival Guide trilogy. Skip to the first entry, Getting Pre-Approved or the third, Choosing a House.. Part Two: Calculating CostsFollowing mortgage loan pre-approval, you will...

Editor's Note: This article is the second in Lender411's Buying Your First Home, The Survival Guide trilogy. Skip to the first entry, Getting Pre-Approved or the third, Choosing a House.. Part Two: Calculating CostsFollowing mortgage loan pre-approval, you will...

Refinance Closing Costs

The costs of a refinance will differ depending on your lender, location, and loan amount. However, some costs will most likely stay the same. In general, you will end up paying anywhere from 3% to 6% of the loan’s principal balance.. Upfront FeesWhen you refinance a home,...

The costs of a refinance will differ depending on your lender, location, and loan amount. However, some costs will most likely stay the same. In general, you will end up paying anywhere from 3% to 6% of the loan’s principal balance.. Upfront FeesWhen you refinance a home,...

VA Loan Closing Costs

For military borrowers, VA loans provide exceptional benefits exclusive to active duty servicepersons and military veterans. To provide assistance for veterans, the Department of Veteran Affairs (VA) enforces strict guidelines on the closing costs which lenders can...

For military borrowers, VA loans provide exceptional benefits exclusive to active duty servicepersons and military veterans. To provide assistance for veterans, the Department of Veteran Affairs (VA) enforces strict guidelines on the closing costs which lenders can...

What is the Purpose of APR?

The majority of borrowers may have heard the acronym APR, but many don't understand it or the factors that contribute to its calculation. . This article will explain the purpose of APR, how APR functions, the fees used to calculate APR, as well as the limitations of...

The majority of borrowers may have heard the acronym APR, but many don't understand it or the factors that contribute to its calculation. . This article will explain the purpose of APR, how APR functions, the fees used to calculate APR, as well as the limitations of...

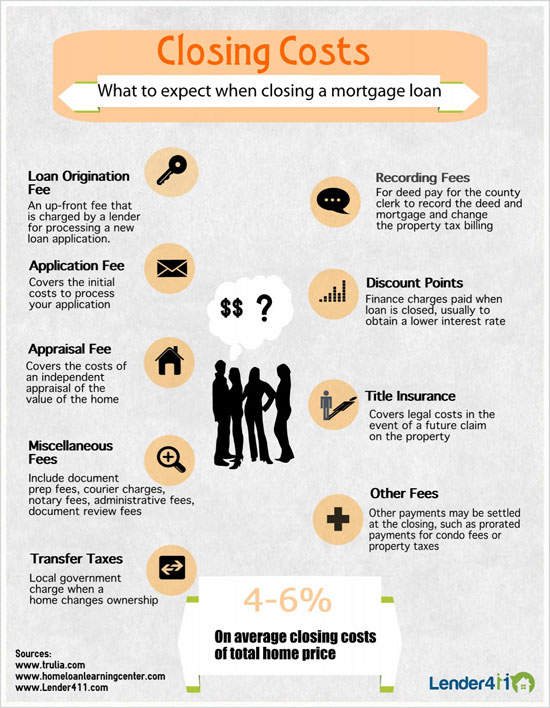

Infographic: Closing Costs

This infographic illustrates the closing costs associated with borrowing a loan. Closing costs include the origination fee, application fee, appraisal fee, transfer tax, title insurance, discount points and other miscelaneous fees. Closing costs on average are...

This infographic illustrates the closing costs associated with borrowing a loan. Closing costs include the origination fee, application fee, appraisal fee, transfer tax, title insurance, discount points and other miscelaneous fees. Closing costs on average are...

Ask our community a question.

Get an answer

Related Articles

Featured Lenders

Lisa Stepp

RBS Citizens

Clifton Park, NY

Cameron Burke

Vision One Mortgage

Huntington Beach, CA

Kat Whitman

Whitman Met, Inc.

Sacramento, CA