Economic Recovery Sends Mortgage Default Rate Lower

By Gretchen Wegrich Updated on 3/19/2013By Gretchen Wegrich

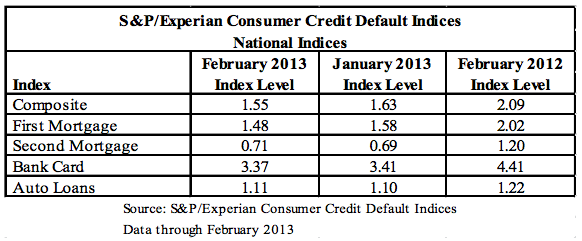

The primary mortgage default rate fell .10 from 1.58% to 1.48% between January and Febrtuary, reported S&P Down Jones and credit bureau Experian.

Contrastingly, the second mortgage default rate rose from 0.69% in January to .71% in February.

S&P Dow Jones managing director David Blitzer remarked, "These trends are consistent with other economic news --improvements in employment and overall economic activity and continuing gains in housing. Additionally, foreclosure activity continues to decline even though it remains at elevated levels compared to the period before the financial crisis."

Of the five cities reviewed in the index report, three reported lower February default rates. Miami saw the largest rate decrease at 24 basis points. Los Angeles followed with 18 basis points and New York with 12 basis points.

Dallas rose by seven basis points while Chicago rose just one basis points.

Miami reached the highest default rate a 3.21 while Dallas posted the lowest default rate at 1.26%. All five cities reported lower default rates than in February 2012.

Didn't find the answer you wanted? Ask one of your own.

-

What You Need To Know About Escrow

View More

What You Need To Know About Escrow

View More

-

President Obama Initiates Lower FHA Mortgage Insurance Premiums

View More

President Obama Initiates Lower FHA Mortgage Insurance Premiums

View More

-

What is Quantitative Easing?

View More

What is Quantitative Easing?

View More

-

The 5 New Mortgage and Housing Trends for Summer 2013

View More

The 5 New Mortgage and Housing Trends for Summer 2013

View More

-

Fannie Mae profitability skyrockets

View More

Fannie Mae profitability skyrockets

View More

-

Foreclosure protections for more soldiers after lawmakers draft bill

View More

Foreclosure protections for more soldiers after lawmakers draft bill

View More

-

FHFA: HARP success follows low mortgage rates, February refinance volume strong

View More

FHFA: HARP success follows low mortgage rates, February refinance volume strong

View More

-

Use of Mortgage Interest Deduction Depends on Where You Live

View More

Use of Mortgage Interest Deduction Depends on Where You Live

View More

-

HUD will sell 40,000 distressed loans in 2013

View More

HUD will sell 40,000 distressed loans in 2013

View More

-

Mortgage Principal Reduction Could Save Taxpayers $2.8 Billion

View More

Mortgage Principal Reduction Could Save Taxpayers $2.8 Billion

View More

-

Mortgage Applications Regain Traction after Sluggishness, Rates Continue to Fall

View More

Mortgage Applications Regain Traction after Sluggishness, Rates Continue to Fall

View More

-

HARP 3.0 Discussions Reveal Little Hope for HARP Update

View More

HARP 3.0 Discussions Reveal Little Hope for HARP Update

View More

-

Home Prices Rise in February According to LPS Data

View More

Home Prices Rise in February According to LPS Data

View More

-

Balancing Act: House Committee Hears Opposing Viewpoints Over Mortgage Interest Rate Deduction

View More

Balancing Act: House Committee Hears Opposing Viewpoints Over Mortgage Interest Rate Deduction

View More

-

Near Record Low Mortgage Rates Buoy Housing Recovery

View More

Near Record Low Mortgage Rates Buoy Housing Recovery

View More

Related Articles

Ask our community a question.

Searching Today's Rates...

Featured Lenders